Aviation Lubricants Market: Adoption of Bio-based Oils Rises as Environment-related Issues Become the Focus

The push for environmentally-friendly products used across industries has gained traction in recent years, the influence of which has reached the aviation lubricants market as well. As a way of reducing the negative impact of aviation lubricants on the environment, manufacturers and end users are increasingly looking at biodegradable alternatives to available aviation lubricants. Bio-based oils, which are quickly attaining popularity, are derived from plant based, renewable sources, and generally consist of vegetable oil. This has caused considerable activity in the landscape, with companies focusing R&D investments toward innovating products that are non-hazardous products, biodegradable, and bio-based.

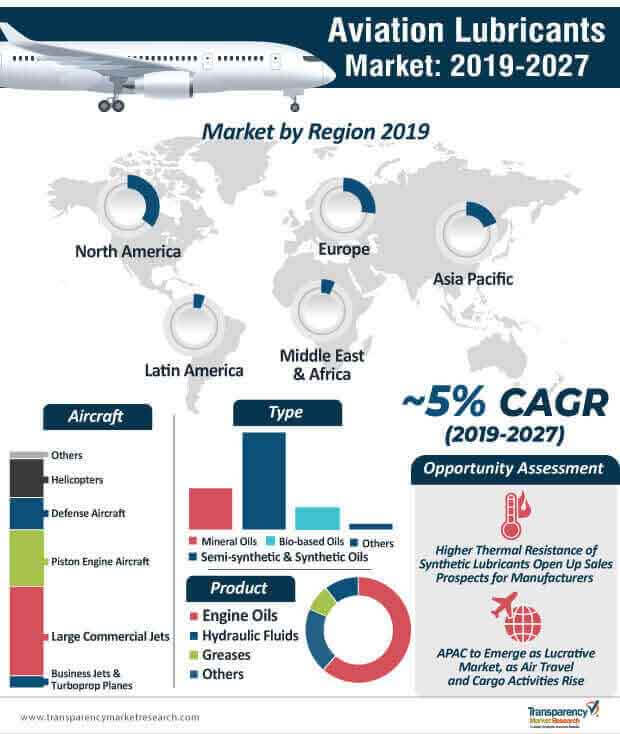

Riding this wave of popularity, in 2018, the bio based lubricants segment in the global aviation lubricants market accounted for ~13% of the global market share, with sales amounting to ~12 thousand tons. It is expected to grow over the forecast period, to hit the ~20 thousand ton mark by the end of 2027.

To gauge the scope of customization in our reports Ask for a Sample

Mineral vs. Synthetic Lubricants

Conventional lubricants that are used by end users of the aviation lubricants market are usually either mineral or synthetic lubricants, categorised based on how they are produced. Mineral oil-based lubricants are generally derived from refining crude oil to remove the hydrocarbons present. This is generally a low-cost option and because they move slowly through the engine, and, as such, remains a less popular option of aviation lubricants when compared to synthetic alternatives.

Get an idea about the offerings of our report from Report Brochure

Synthetic and semi-synthetic lubricants, which held the largest share, accounting for over half of the global market, are expected to remain popular in the years to come. Containing fewer impurities than mineral oil, and being chemically modified, they are more efficient than their mineral counterparts, contributing to their popularity. This segment, which was valued at ~US$ 550 Mn in 2018, is expected to grow steadily and hit the ~US$ 900 Mn mark by the end of 2027. However, the mineral oil segment is also likely to steadily expand, progressing at a CAGR of ~5% by revenue share during the course of the forecast years.

A side-by-side comparison of conventional mineral oil-based lubricants versus semi-and synthetic oil lubricants demonstrates the superiority of synthetic oil on several fronts, including efficiency, biodegradability, and thermal and oxidative stability, which is set to shape the further evolution of the market.

Stability of Airline Industry to Positively Contribute to Market Growth

Rise in air travel and cargo activities, globally, is one of the biggest factors contributing to the growth of the airline industry, and subsequently the aviation lubricants market. Stakeholders in the global aircraft landscape are increasingly taking advantage of this trend, as they strengthen their commercial fleets in developing countries around the world. This particularly applies to growing markets around the world, where the increase in air traffic is likely to augment the growth of the global aviation lubricants market in the foreseeable future.

North America – Lucrative Regional Market

North America held the most significant share of the global aviation lubricants market, accounting for around one-third of the total market share, volume-wise, in 2018. It is expected to expand steadily at a CAGR ~5% by volume over the forecast period, while continuing to remain the largest regional market in the global landscape. This can be attributed to the existing military fleet that is being gradually upgraded, which has an indirect impact on the growth of the market in this region. The presence of a number of manufacturers and key players in the aviation lubricants market in North America is also understood to have a positive influence on the expansion of the market in the region.

However, expanding the fastest at a value CAGR of ~6% is Asia Pacific, which was valued at ~US$ 195 Mn in 2018, and is expected to expand 1.5X, to reach the ~US$ 335 Mn mark by the end of the forecast period of 2027. Rising air traffic and cargo activities can be credited to the growth of this regional market, as it is opening up a plethora of opportunities for stakeholders in the aviation lubricants market.

Buy Complete Report@:

https://www.transparencymarketresearch.com/checkout.php?rep_id=41393<ype=S

Global Aviation Lubricants Market: Description

- Lubricants used in the aviation sector need to have much better performance than those used in other sectors such as automotive and industrial. Lubrication is required for engines and airframe designs. Lubricants evolve along with evolution in the design and the technology of aircraft.

- Aviation lubricants are exposed to temperatures ranging from −73°C to 200°C. They are used in a wide range of commercial, military, and general applications.

- Over the next 20 years, the global aircraft fleet is expected to nearly double. Aviation lubricants are used in oxygen system couplings, valves, regulators and seals, liquid-fueled rocket engines and ground support systems, instruments, gyroscopes and gimbals, pneumatics, bearings, leadscrews and ball screws, electromechanical actuators, engine ancillary gearbox spline couplings, anti-friction mounts, engine oil tanks, and IR sensors and optics.

- The global aviation lubricants market is projected to expand at a CAGR of ~5% over the forecast period.

- As such, the global aviation lubricants market is expected to increase from a value of ~US$ 910 Mn in 2019 to ~US$ 1.4 Bn by the end of 2027.

Key Drivers of Global Aviation Lubricants Market

- Increasing demand for air travel and rising cargo activities are key factors that are catalyzing the growth of the global aerospace industry. The emergence of a large-sized middle class, increasing urbanization, and growth of megacities are encouraging people to move around from one city to another for business and/or personal reasons.

- Growth in cargo activities is another key factor driving the number of aircraft. This, in turn, is boosting the demand for aviation lubricants across the globe. The aircraft industry is expected to continue to shift from the mature markets of North America and Europe toward emerging markets, particularly Asia, in the near future. China and India are anticipated to become key countries in the aircraft industry in the near future.

- Thus, increase in air travel and growth in cargo activities are projected to propel the demand for aircraft in the next few years. This, in turn, is likely to augment the global aviation lubricants market during the forecast period.

Major Challenges for Global Aviation Lubricants Market

- Aviation is the most time-saving means of transport. However, operational costs are too high. Air transport requires high investments for the construction and maintenance of aircraft. It also requires trained, experienced, and skilled personnel, which involves substantial investments. High expenditure is required on the construction of aerodromes as well as aircraft.

- This factor is expected to hamper the global aviation industry, which, in turn, is likely to restrain the global aviation lubricants market during the forecast period.

Lucrative Opportunities for Global Aviation Lubricants Market

- The governments of various countries are focusing on policies regarding open skies, visa, and immigration. Countries such as India and China have taken initiatives, which are primarily government-driven, to boost air travel.

- India’s ‘Ude Desh ka Aam Nagrik’ Regional Connectivity Scheme or UDAN-RCS is a government initiative to make domestic flying more accessible to its citizens. It strives to make air travel more affordable and convenient. The Government of India also aims to stimulate economic growth through this initiative.

- The Belt and Road Initiative (BRI) adopted by China has augmented air traffic to and from the country. For example, Kenya and Vietnam experienced higher traffic growth to and from China from 2013 to 2017 as compared to the previous five years.

- Some estimates list the Belt and Road Initiative as one of the largest infrastructure and investment projects in history, covering more than 68 countries, around 65% of the world’s population, and 30% of the global GDP as of 2017. The initiative is likely to drive the global aviation industry during the forecast period, thereby boosting the global aviation lubricants market.

North America to Dominate Global Aviation Lubricants Market

- North America is a leading consumer of aviation lubricants. The U.S. is the prominent producer and consumer of aviation lubricants in the region. North America is expected to lead the global aviation lubricants market, in terms of volume and value, during the forecast period.

- North America also has the largest fleet of general aviation aircraft. Furthermore, the general aviation sector in the region has been expanding significantly. Increase in the demand for aviation lubricants for use in these general aviation aircraft is estimated to drive the aviation lubricants market in the region during the forecast period.

Asia Pacific to Offer Growth Opportunities

- Asia Pacific is another prominent region in the aviation lubricants market, in terms of consumption of aviation lubricants. China is a highly lucrative market for aviation lubricants in Asia Pacific.

- Various aircraft manufacturers are striving to strengthen their commercial and industrial ties in China and India. According to Airbus, the demand for passenger and freight aircraft is forecast to reach 37,400 in the next 20 years, wherein, Asia Pacific is estimated to account for 42% of deliveries.

- Increase in the demand for aviation lubricants for use in the commercial and general aviation sectors is expected to augment the aviation lubricants market in Asia Pacific during the forecast period.

Leading Players Actively Engage in Mergers and Acquisitions

- Key players operating in the global aviation lubricants market are

- Royal Dutch Shell Plc.

- ExxonMobil Corporation

- Total Group

- NYCO

- Eastman Chemical Company

- The Chemours Company

- Phillips 66 Company

- Nye Lubricants, Inc.

- These companies are engaged in expansions, mergers & acquisitions, and joint ventures in order to increase their share of the global aviation lubricants market.

- In November 2017, Shell opened an integrated production facility for lubricants and greases in Tuas, Singapore. It was the company’s third-largest lubricants plant in the world and the second-largest in Asia Pacific. The plant is capable of producing up to 430 million liters of lubricants and greases every year.

Read Our Latest Press Release:

About Us

Transparency Market Research is a next-generation market intelligence provider, offering fact-based solutions to business leaders, consultants, and strategy professionals.

Our reports are single-point solutions for businesses to grow, evolve, and mature. Our real-time data collection methods along with ability to track more than one million high growth niche products are aligned with your aims. The detailed and proprietary statistical models used by our analysts offer insights for making right decision in the shortest span of time. For organizations that require specific but comprehensive information we offer customized solutions through ad-hoc reports. These requests are delivered with the perfect combination of right sense of fact-oriented problem solving methodologies and leveraging existing data repositories.

Contact

Transparency Market Research State Tower,

90 State Street,

Suite 700,

Albany NY – 12207

United States

USA – Canada Toll Free: 866-552-3453