Asset and Wealth Management: Robotic Advisors are Here to Stay

Being vulnerable to various geopolitical, macro, and microeconomic factors, and regulatory frameworks, the investment sector has always had a significant impact on the cluster of its closely-related industries, including the asset and wealth management segment. As a result of the wave of digitalization, the asset and wealth management ecosystem is moving towards innovative ways to offer digital, yet cost-effective solutions, and eventually, robotic advisors or robo advisors have gained immense popularity among market players.

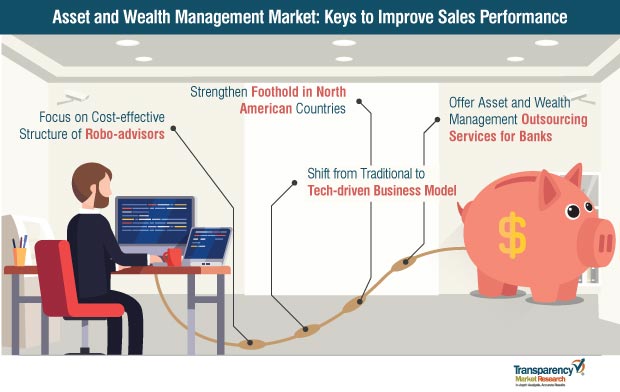

As cost margins are squeezed in the asset and wealth management industry due to the strict regulatory environment and increased customer price sensibility, robo-advisors are becoming a cost-efficient option for companies in the market. Robo-advisors are likely to enhance – not replace – the job of human advisors in the asset and wealth management market, redefining the emerging trends in the landscape.

The takeover of the investment sector by the digital generation has been fueling technological innovation in the asset and wealth management landscape, and a recent study published by Transparency Market Research (TMR) tracks the impacts of the undercurrents in the market.

Free Customization as per your requirement, Buy Now

Asset and Wealth Management Emerging from One-to-one Advisement to New Tech-driven Options

In the rapidly-advancing and hyper-competitive investment industry, the old ways of product-led solutions for asset and wealth management have become completely obsolete. Investors are demanding more profitable options for asset and wealth management that can also ensure regulatory compliance. The industry is moving away from being tech-shy, and this has induced a tectonic shift from the adoption of hardware-based asset and wealth management solutions to their software-based variants.

In 2018, the asset and wealth management space reached a valuation of ~ US$ 3.8 million, and it is expected to reach the ~ US$ 3.9 million mark in 2019. Advancements in technologies, generational changeover of wealth, and a major overhaul of regulatory policies indicate an inflection point of the asset and wealth management market. Increasing regulatory pressures are encouraging asset and wealth managers to embrace new digital FinTech solutions to improve efficiency and reduce costs.

The onerous regulatory environment will continue to influence asset and wealth management business models, which will reflect in tremendous rise in electronification. However, most asset and wealth management firms are still holding onto traditional and outdated execution models, lacking technological expertise for trading technology integration.

While the asset and wealth management landscape remains highly volatile due to the changing regulatory framework, relentless cost pressures are further coercing market players to quickly adopt new tech-driven investment strategies.

Get More Press Releases by TMR: https://www.prnewswire.com/news-releases/automotive-on-board-diagnostics-market-to-present-vast-canvas-for-oems-and-providers-to-capitalize-on-telematics-based-insurance-valuation-projected-to-touch-us-22-bn-by-2031—tmr-301290974.html

In addition, the emerging investor base, which is more digitally-oriented, is adding to this pressure of electronification. As such, the need for offering a fluid multi-channel customer experience by shifting to next-generation trading technologies in a short time span will continue to remain a critical challenge for asset and wealth management firms in the coming years.

Outsourced Asset and Wealth Management Services for Banks to Prove Profitable

The positive growth prospects of the asset and wealth management landscape can mainly be attributed to the trend of outsourced chief investment officer (OCIO) in end-user organizations. A mounting number of asset and wealth management firms are inclining towards offering outsourced services, as this gives them access to thousands of businesses in a broader range of industries.