Being vulnerable to various geopolitical, macro, and microeconomic factors, and regulatory frameworks, the investment sector has always had a significant impact on the cluster of its closely-related industries, including the asset and wealth management segment. As a result of the wave of digitalization, the asset and wealth management ecosystem is moving towards innovative ways to offer digital, yet cost-effective solutions, and eventually, robotic advisors or robo advisors have gained immense popularity among market players.

As cost margins are squeezed in the asset and wealth management industry due to the strict regulatory environment and increased customer price sensibility, robo-advisors are becoming a cost-efficient option for companies in the market. Robo-advisors are likely to enhance – not replace – the job of human advisors in the asset and wealth management market, redefining the emerging trends in the landscape.

The takeover of the investment sector by the digital generation has been fueling technological innovation in the asset and wealth management landscape, and a recent study published by Transparency Market Research (TMR) tracks the impacts of the undercurrents in the market.

Planning to lay down future strategy? Perfect your plan with our report brochure here

Asset and Wealth Management Emerging from One-to-one Advisement to New Tech-driven Options

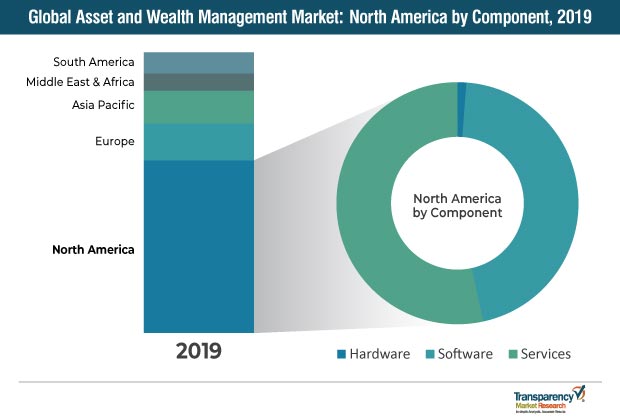

In the rapidly-advancing and hyper-competitive investment industry, the old ways of product-led solutions for asset and wealth management have become completely obsolete. Investors are demanding more profitable options for asset and wealth management that can also ensure regulatory compliance. The industry is moving away from being tech-shy, and this has induced a tectonic shift from the adoption of hardware-based asset and wealth management solutions to their software-based variants.

In 2018, the asset and wealth management space reached a valuation of ~ US$ 3.8 million, and it is expected to reach the ~ US$ 3.9 million mark in 2019. Advancements in technologies, generational changeover of wealth, and a major overhaul of regulatory policies indicate an inflection point of the asset and wealth management market. Increasing regulatory pressures are encouraging asset and wealth managers to embrace new digital FinTech solutions to improve efficiency and reduce costs.

The onerous regulatory environment will continue to influence asset and wealth management business models, which will reflect in tremendous rise in electronification. However, most asset and wealth management firms are still holding onto traditional and outdated execution models, lacking technological expertise for trading technology integration.

While the asset and wealth management landscape remains highly volatile due to the changing regulatory framework, relentless cost pressures are further coercing market players to quickly adopt new tech-driven investment strategies.

In addition, the emerging investor base, which is more digitally-oriented, is adding to this pressure of electronification. As such, the need for offering a fluid multi-channel customer experience by shifting to next-generation trading technologies in a short time span will continue to remain a critical challenge for asset and wealth management firms in the coming years.

Want to know the obstructions to your company’s growth in future? Request a PDF sample here

Outsourced Asset and Wealth Management Services for Banks to Prove Profitable

The positive growth prospects of the asset and wealth management landscape can mainly be attributed to the trend of outsourced chief investment officer (OCIO) in end-user organizations. A mounting number of asset and wealth management firms are inclining towards offering outsourced services, as this gives them access to thousands of businesses in a broader range of industries.

In 2018, asset and wealth management services accounted for half the revenue share of this landscape, and the trend is likely to grow stronger with the rise of outsourced OCIO firms in the industrial environment. Asset and wealth management firms are likely to increase focus on the banking sector, as most banks and specialty finance institutions are flocking to adopt digital asset and wealth management services.

Banks accounted for ~ 40% revenue share of the asset and wealth management landscape in 2018. In the coming years, the increasing need for enhancing customer experience and expanding into new markets will continue to create more lucrative opportunities for asset and wealth managers in the banking sector. Leading players in the landscape are expected to support the journey of digital transformation of banks with technologically-advanced asset and wealth management services.

Looking for exclusive market insights from business experts? Request a Custom Report here

North America Remains the Largest Revenue Pocket for Asset and Wealth Managers

Though developing economies have leapfrogged developed countries in terms of industrial growth, the relatively stronger economic status of the United States (U.S.) and other leading European economies has remained the driving engine for asset and wealth management in developed regions.

Increasing growth of the investment sector in North America indicated a palpable shift towards high-tech asset and wealth management solutions, not only among large enterprises but also across the long tail of smaller businesses. In 2018, revenue share of the asset and wealth management market in North America was ~ 60% of the global market, and this is expected to increase even further in the foreseeable future.

Market leaders are adopting fee compression strategies, employing pricing of asset and wealth management solutions as a lever to grow in North America. Meanwhile, in developing countries, especially in Asia Pacific, the strategies of market players are likely to revolve around improving technological penetration to leverage increasing economic growth of the region, in the near future.

Changing Competitive Landscape Influenced by the Impacts of Coopetition

The competitive landscape of the asset and wealth management market is highly consolidated, with ~ 30% revenue share of leading market players and ~ 40% revenue share of their prime competitors in the market. Though the frontrunners have a stronghold on this landscape, emerging players offering highly-personalized and data-driven asset and wealth management services continue to pose a threat to their position in the market.

Market leaders, including IBM Corporation, Fidelity National Information Services, Inc. (FIS), and Infosys Limited, are competing on technological expertise, and continue to gain customer trust with their cyber-security solutions. Meanwhile, their competitors and emerging players, such as SAS Institute, Tata Consultancy Services (TCS), and Capgemini SE, have adopted strategies such as joining forces with other businesses to improve their sales performance in the asset and wealth management market.

Read TMR Research Methodology at: https://www.transparencymarketresearch.com/methodology.html

Some of the examples include,

- In March 2018, SAS Institute announced that it had partnered with Wolters Kluwer – a leading information services company based in the Netherlands, to offer an integrated finance and risk management, and regulatory reporting software solution to ABN AMRO Bank N.V. – a leading Dutch bank with its headquarters in Amsterdam. The company also declared that, the software solution will be the integration of the SAS® risk and finance solution for finance and risk analytics and Wolters Kluwer’s OneSumX for regulatory reporting; and asset and liability management (ALM).

- In November 2018, TCS, announced that it had purchased the assets of BridgePoint Group, LLC – a U.S.-based financial services and management consulting firm. TCS declared that, while it had already partnered with the top eight banking, financial services, and insurance institutions (BSFIs) in the U.S., this acquisition would strengthen its foothold in financial services and insurance domain knowledge, especially in the U.S. retirement services segment.

- In October 2018, Capgemini announced that it had acquired 20% stake in Azqore, a subsidiary of Indosuez Wealth Management—the wealth management brand of the Crédit Agricole group, which offers its technology outsourcing services in the wealth management sector in Europe. The company further declared that, this coopetition would complement Capgemini’s expertise with a wide range of digital wealth management solutions in the technology outsourcing and banking transactions market of Europe.

Read Our Latest Press Release:

- https://www.prnewswire.co.uk/news-releases/rising-influence-of-automation-to-paint-strokes-of-growth-across-proximity-sensors-market-between-2019-and-2027-tmr-868639913.html

- https://www.prnewswire.com/news-releases/global-higher-education-solutions-market-to-thrive-on-growing-popularity-of-cloud-computing-and-high-consumption-of-digital-content-tmr-301219732.html

About Us

Transparency Market Research is a next-generation market intelligence provider, offering fact-based solutions to business leaders, consultants, and strategy professionals.

Our reports are single-point solutions for businesses to grow, evolve, and mature. Our real-time data collection methods along with ability to track more than one million high growth niche products are aligned with your aims. The detailed and proprietary statistical models used by our analysts offer insights for making right decision in the shortest span of time. For organizations that require specific but comprehensive information we offer customized solutions through ad-hoc reports. These requests are delivered with the perfect combination of right sense of fact-oriented problem solving methodologies and leveraging existing data repositories.

Contact

Transparency Market Research State Tower,

90 State Street,

Suite 700,

Albany NY – 12207

United States

USA – Canada Toll Free: 866-552-3453

Email: [email protected]