Renewable Energy Management Fuels Demand for Ancillary Services for Power

The competition for ancillary services has intensified due to the rising trend of distributed power generation. As such, the ancillary services for power market is fragmented with emerging market players accounting for a cumulative revenue share of ~88%. Thus, rising amount of intermittent distributed generation of wind and solar energy has fueled the demand for ancillary services. Greater fluctuation in system frequency and local network congestion are some of the key drivers that are catalyzing growth of the ancillary services for power market.

On the other hand, renewable power sources, such as the solar and wind energy are growing popular, owing to their cost efficiency attributes as compared to conventional power. As such, Europe is growing as the hub for harnessing the advantages of wind energy, resulting in increased demand for ancillary services for power. There is a need for better policies and regulations to streamline the ancillary services for power pertaining to renewable energy (RE) sources.

Request a sample to get extensive insights into the Ancillary Services for Power Market

Adjustable Power Reserves Play Key Role in Balancing of Electricity

Since electricity is stored in limited volumes, in several cases, consumer demands exceed the generation of electricity. Hence, companies in the ancillary services for power market are increasing their R&D activities in adjustable power reserves that play an instrumental role in upward and downward balancing. For instance, RTE France- an ancillary services provider for renewable energy, is increasing efforts to innovate in both automatically and manually activated reserves to meet specific needs of users.

To understand how our report can bring difference to your business strategy, Ask for a brochure

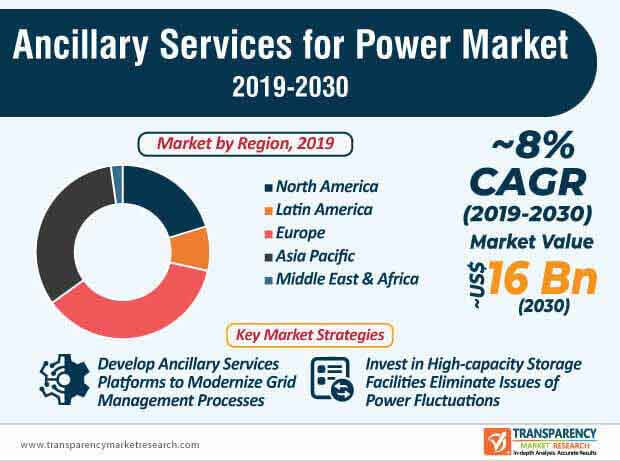

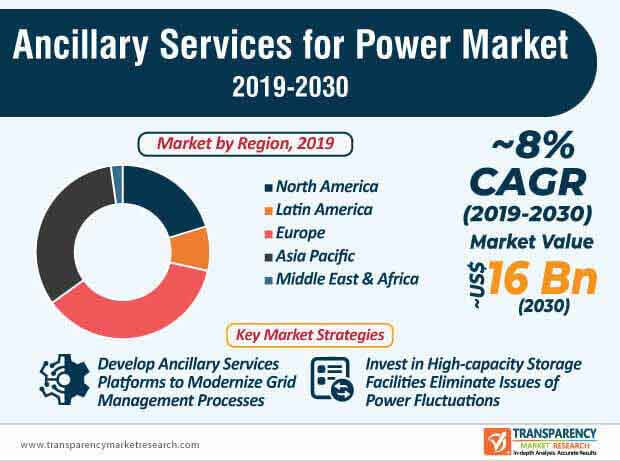

The ancillary services for power market is projected to reach a revenue of ~US$ 16 Bn by the end of 2030. This is evident, since coal-based electricity generation in the India ancillary services for power market is being replaced by renewable energy plants. Thus, renewable energy generation is one of the key trends, which is fueling growth for the market of ancillary services for power.

Robust Storage Facilities Help Overcome Limitations of Output Fluctuations for RE Plants

Companies in the ancillary services for power market are undertaking pilot projects pertaining to renewable energy plants in redispatch. However, output fluctuations and network congestions are some of the key challenges that are restricting the adoption of RE plants.

The global ancillary services for power market is projected to advance at a CAGR of ~8% during the assessment period. The trend of RE generation is becoming increasingly prominent in countries of Asia. As such, Asia Pacific is predicted to generate the second-highest revenue among all regions in the market for ancillary services for power. However, technical and political challenges pertaining to output fluctuations and network congestion are likely to impede growth for the market of ancillary services for power. Hence, operators are investing in the establishment of robust storage facilities involving high-capacity batteries and pumped storage hydro power.

Hourly Real-time Demarcation of Energy Trade Deploys Greater Efficiency in Ancillary Services

Distribution companies (discom) in the ancillary services for power market prepare power procurement plans to eliminate any uncertainties regarding the demand and supply of electricity. This planning is typically carried out for a long period of over seven years, medium and short-term period of only months to set the demand and generation expectations correctly for discoms. However, real-time balance of the demand and supply of electricity has its uncertainties, making it difficult to balance the grid. Hence, companies in the ancillary services for power market are increasing efforts to achieve a clear demarcation between energy trade and system imbalance handling.

A proposed hourly real-time demarcation is expected to deploy greater efficiency in ancillary services for power and price discovery.

Ancillary Services Platforms Deploy Robust Internet Connectivity Between Grid Operators and Service Providers

Europe is at the forefront in terms of revenue growth in the ancillary services for power market. This is evident since discoms in the U.K. are increasing efforts to launch a new platform involving ancillary services for power, in order to modernize its grid management toolkit. For instance, National Grid ESO-an investor-owned energy company announced the launch of their Platform for Ancillary Services (PAS) program, which provides information related to the service providers, dispatch services, and others. Thus, the trend of electronic instructions is bringing about a change in the ancillary services for power market.

Companies in the ancillary services for power are adopting platforms that deploy robust internet connectivity between the grid operators and service providers.

More Trending Reports by Transparency Market Research – https://www.prnewswire.com/news-releases/global-enzymes-market-to-grow-at-8-annually-to-reach-usd-12-2-billion-valuation-by-2027-transparency-market-research-301000183.html

Power Trading and Hourly Demarcations Grow Prominent amidst COVID-19 Crisis

New set of regulations are being introduced to manage real-time markets such as the ancillary services for power amidst the COVID-19 outbreak. The Central Electricity Regulatory Commission (CERC) in India has decided to defer implementations in the real-time power market and has introduced new set of regulations that are currently being practiced. Thus, grid operators and service providers in other countries are taking cues from the CERC in India and brainstorming over techniques that can help in better resource utilization.

Due to ongoing developments in the COVID-19 outbreak, companies in the India ancillary services for power market are shifting their focus from long-term contracts to short-term contracts due to potential uncertainties in energy trade demarcations. The concept of hourly ream-time demarcation is growing prominent amidst the COVID-19 pandemic to avoid instances of power fluctuations and network congestion. This has led to power trading where discoms can buy power a day before in real-time markets.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Ancillary Services for Power Market

Analysts’ Viewpoint

Analysts’ Viewpoint

New regulations pertaining to power trading and hourly demarcations are being practiced in the India ancillary services for power market amidst the COVID-19 pandemic. As such, due to the growing trend of renewable energy power in India, there is a need for effective grid management capabilities to deliver flexibility in distributed energy resources.

Ancillary services platforms are a novel introduction in the market and play a key role in effective grid management protocols. However, the issues of uncertainty in distributed energy resources and voltage deviation are restricting the adoption of RE plants in Asian countries. Hence, companies should streamline the processes in power bidding and introduce smart meters to avoid instances of voltage deviation.

Ancillary Services for Power Market: Overview

- Ancillary services help transmit electricity from generators to consumers considering the obligations of control areas. They enable to transmit utilities within the control areas. Ancillary services are provided by the electric grid that supports and facilitates the continuous flow of electricity so that supply can meet demand.

- Ancillary services refers to several operations beyond generation & transmission that are required to maintain grid security and stability. Ancillary services include operating reserves, frequency control, and voltage control.

Rise in Demand for Power Infrastructure to Drive Ancillary Services for Power Market

- Rise in demand for electricity, primarily in developing and underdeveloped countries, has led to expansion of power infrastructure. Furthermore, government electrification programs are attracting investments in the power sector.

- The electrification trend began to accelerate in 2015. Global electrification rate reached 89% in 2018. Around 153 million people received electricity at an annual rate of more than 1% in 2018. This momentum remained uneven across regions in difficult-to-reach populations, particularly in Sub-Saharan Africa, where many still remain without access to electricity.

- Electrification efforts have been particularly successful in Central and Southern Asia, where 91% of the population had access to electricity in 2017. Access rates in Latin America and the Caribbean as well as Eastern and Southeastern Asia climbed to 98% in 2017.

- Among the 20 countries with the largest population lacking access to electricity, India, Bangladesh, Kenya, and Myanmar have made significant progress since 2010. The target of global access to electricity can be achieved by 2030 if the rate of progress in expanding access to electricity remains at the same level as that between 2015 and 2017.

- Adoption of key strategies to increase access to electricity is boosting the demand for ancillary services. Ancillary services help system operators continuously take measures to keep the frequency, voltage, and load of the operating equipment within the permitted tolerances or bring them to the normal range after faults.

Increase in Adoption of Renewable Energy to Boost Ancillary Services for Power Market

- Integration of renewable energy in grid has increased significantly over the last few years, due to substantial decline in solar and wind development costs. Introduction of ambitious climate policies in several countries across the globe, including the U.S., China, India, Japan, Australia, and those in the European Union, is also a major factor driving development of renewable technologies.

- Regulators have introduced several targets and incentives to increase the penetration of renewable technologies in the energy mix. For instance, the African Renewable Energy Initiative (AREI) has been introduced with an aim to produce 300 GW of electricity from clean, affordable, and appropriate forms of energy in Africa by 2030.

- Rise in penetration of renewable resources has led to fluctuation in electrical output. This has resulted in an increase in concern about grid stability.

- Grid operators are increasing their focus on implementation of ancillary services, as these services help them maintain a reliable electricity system. Ancillary services enable proper flow and direction of electricity; address imbalances between demand and supply; and help the system to recover after a power failure.

- Thus, rise in share of renewable energy in the power generation sector is anticipated to boost the ancillary services for power market during the forecast period

Request for covid19 Impact Analysis – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=42677

Europe to Dominate Ancillary Services for Power Market

- Europe dominated the global ancillary services for power market in 2019. The U.K. constituted leading share of the ancillary services for power market in the region in the year. Growth of the ancillary services for power market in Europe can be primarily ascribed to the increase in share of renewable technologies in primary energy mix, owing to the rise in focus on reducing the climate change impact.

- Asia Pacific is estimated to be a highly attractive region of the global ancillary services for power market during the forecast period. This trend is expected to continue during the forecast period due to increase in investments in transmission and distribution network, primarily in China and India. Introduction of electrification program and rise in demand for electricity, primarily in rural areas, are some of the key factors attracting investments in development of transmission and distribution network across the region. This, in turn, is likely to augment the demand for ancillary services for power market in Asia Pacific.

- The ancillary services for power market in North America is anticipated to expand at a moderate pace during forecast period. The U.S. constituted leading share of the ancillary services for power market in the region in 2019. Growth of ancillary services in the country can be ascribed to ongoing investments in modernization of transmission & distribution infrastructure.

Highly Competitive Ancillary Services for Power Market

- The global ancillary services for power market is highly competitive, with the presence of large numbers of players operating at local and regional levels

- Key players operating in the ancillary services for power market include

- Snowy Hydro Limited

- New York Independent System Operator

- Elia

- PJM,

- Transelectrica SA

- General Electric

- Independent Electricity System Operator

- Midcontinent Independent System Operator, Inc.

- Alberta Electric System Operator

- Southwest Power Pool, Inc.,

- Electric Reliability Council of Texas