Medicare is a kind of plan that one should take for their health insurance. But achieving these insurances is not that easy as you need to fulfill certain criteria. For example, a person has to pass the age of 65 years only then they can get health insurance. Other young individuals with some disabilities or end-stage renal diseases are treated as exceptions. End-stage renal diseases are kidney failure that needs dialysis for recovery or sometimes a transplant.

There are many Medicare plans offered to people. But if you are being worked full time for ten years or more, then you might be eligible for the Part A of Medicare for free. But if you do not know what these different plans of Medicare offer, then you need to read the below information provided. Here are a few of the plans given that might help you to get a medicare plan.

Medicare plan part A: in this part, all the hospital charges can be covered. When a person stays in a hospital, then all the charges of nursing, hospital care, or health care are covered by the A part of Medicare. When people get hospitalized, and any of the expenses occur in the hospital, then you can recover it from the company through which you have taken your health insurance. Medicare Supplement Plan G is mostly demanded, but people should know n about every plan.

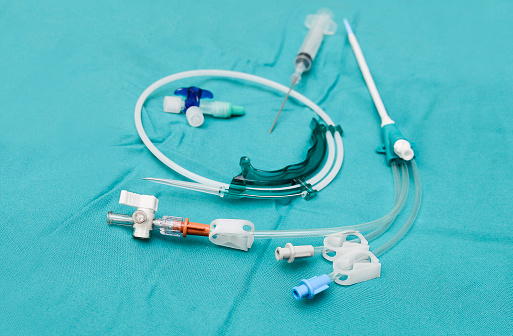

Medicare plan part B: they will help you to deal with every outpatient care. Here they will pay for all your money spent on doctor’s services or any kind of test done for treatment. Health insurance also provides coverage for the supplies also that are consumed by people. These supplies include all types of teats and medical expenses. You can take this plan on a monthly basis or for an annual payment. But some individuals can also acquire them for free.

Medicare plan part C: if you have contacted a medicare service provider, then you might know that the government provides these. But medicare plan part C is actually offered by private insurance companies where they cover parts A and B of Medicare. From so many medicare supplement plans, it is hard to select one as all of them differ when the needs of people changes. But still, Medicare Supplement Plan G is considered to be the best for the majority of people.

Medicare plan part D: this part contains the prescription drug coverage. When any of the drugs are prescribed, then with part D, you can take the coverage of original Medicare and the prescription drug too. In addition, the insurance company offers some of the plans: medicare service plans, medicare savings account plans, and private fee-for-service plans.

All the above parts are describing the versatility and coverage of the medicare plans. One should be familiar and well known about the parts of Medicare. You need to understand that you should take insurance from the government and private insurance that are approved as fraud companies are also rarely present.