Algorithmic Trading Market – Snapshot

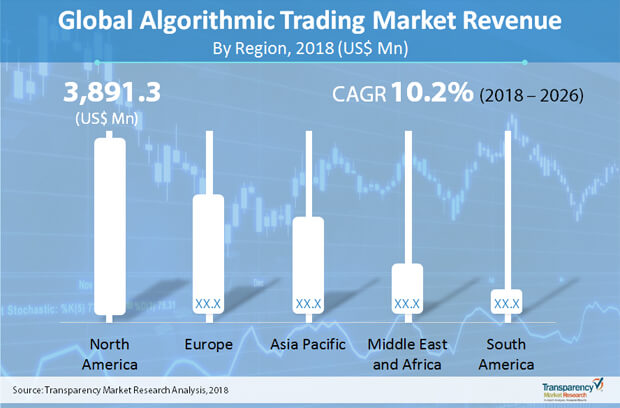

Algorithmic trading is a process of using an automated computer programed to follow a defined set of trading instructions for placing a trade, accounting for factors such as time, price, and volume. Algorithmic trading or algo trading is a technology platform providing advantage of both artificial intelligence and human intelligence. Algorithmic trading helps in reducing transaction costs, allowing investment managers to take control of their own trading procedures. The main objective of such software is not just to maximize profits but also to control market risk and execution costs. The market for algorithmic trading is forecasted to grow to US$ 21,807.6Mn by 2026, recording a CAGR of 10.2%.

End users and prospective adopters are attracted to the several benefits that algorithmic trading over manual ones. Faster execution, less risk of errors, concurrent focus on several market conditions are some of the key benefits which is evident in high-frequency trading (HFT). In addition, adopters have been able to backtest their tradition system. Most importantly, the popularity of products in the algorithmic trading market has stemmed from the fact that it has been successful in taking more rationalized decision, the reason having to do with stripping the decisions of human emotions. Post the economic recession of 2008, rules-based decision-making was internalized in algorithmic trading strategies. Rise in different forms of trading has made people look toward the advantages of algorithmic trading. A slew of new strategies have emerged in the market attracting the attention of investment firms and traders of all size.

Customization as per your requirement, Buy Now

Key strategies in the marketplace include trend-following strategies, arbitrage opportunities, index fund rebalancing, and mathematical model-based strategies. However, some genuine concerns are worrying end users and market players. Since, a large part of the trading process is automated, this removes any scope of applying discretion in making choices, a key pillar of economic and financial decision-making. Moreover, system issues, such as power losses and connectivity problems, need to be constantly monitored so as to prevent any huge crash. Also, the need for high-end resources might hurt cost-sensitive consumers in the algorithmic trading market.

Moreover, there is a lack of agreement among regulators on how the algorithmic trading must be adopted and monitored, leading to some serious snags for adopters and industry players in the market. Moreover, since there always exist the possibility of irrationality in economic models, at times this type of trading may fall short. In the times of Covid-19 customer sentiment has reached an all-time low, hampering the prospect of substantive spending. This has also hurt the prospects of the algorithmic trading market. Nonetheless, last few months have also seen improvement in overall consumer spending, which will add momentum to the market.

Get More Press Releases by TMR: https://www.prnewswire.com/news-releases/process-innovations-and-demand-for-value-added-services-create-new-revenue-streams-in-property-tax-services-market-delivery-by-outsourcing-business-model-to-up-the-ante-for-service-providers—tmr-301296021.html

The algorithm trading market has experienced substantial growth due to large number of financial firms opting for increasing automation in trading processes. Integrated financial markets or an open market economy such as the European Union helps local vendors in buying foreign assets with reduced risks. Contribution of several international markets has aided developing countries in generating opportunities for portfolio diversification, global distribution of savings, and also risk sharing.

To gauge the scope of customization in our reports, Ask for a Sample

The algorithmic trading market is driven by the emergence of AI and algorithms in the financial service sector. This in turn is boosting the algorithmic trading sector globally. Furthermore, increasing adoption of non-equity trading algorithms by institutional asset managers is enhancing the use of artificial intelligence in the financial services sector. The global algorithmic trading market is anticipated to grow significantly during the forecast period, attributed to rapidly growing demand for market surveillance. By using market surveillance technology, traders are able to keep track of their trading activities and investment pattern.The rising need to build an economy with global as well as regional interdependencies force key vendors to formulate effective marketing strategies and develop new solutions for market surveillance. In addition, many companies are inclined toward the use of algorithmic trading in order to reduce market risks and transaction cost.

However, stringent regulatory guidelines are affecting the large-scale use of algorithmic trading. To conduct algorithmic trading and high frequency trading (HFT), all trading companies should inform the national regulatory authority and submit an application for approval from the regulatory authority.The regulatory environment for algorithmic trading and HFT practices are not favorable in some of the major countries such as China. There are barriers to the widespread application of automated trading, specifically for high frequency trading in financial markets across the country. This is consequently restricting the growth of the algorithmic trading market across the Asia Pacific region, as China is one of the major markets for the stock exchange.

Contact us:

Transparency Market Research

State Tower,

90 State Street, Suite 700,

Albany NY – 12207,

United States

Tel: +1-518-618-1030

Site: https://todaysmarkettrends.wordpress.com