Advances in digital and mobile innovation have seen new and current improvements change the manner in which we get things done. Shopping and doing payments for administrations will to never be an identical again. An ever increasing number of individuals, likewise as organizations, are beginning to accept and receive current payment strategies that make business and trade more secure, accessible to a more prominent number of people , while adding a substitute kind of payment.

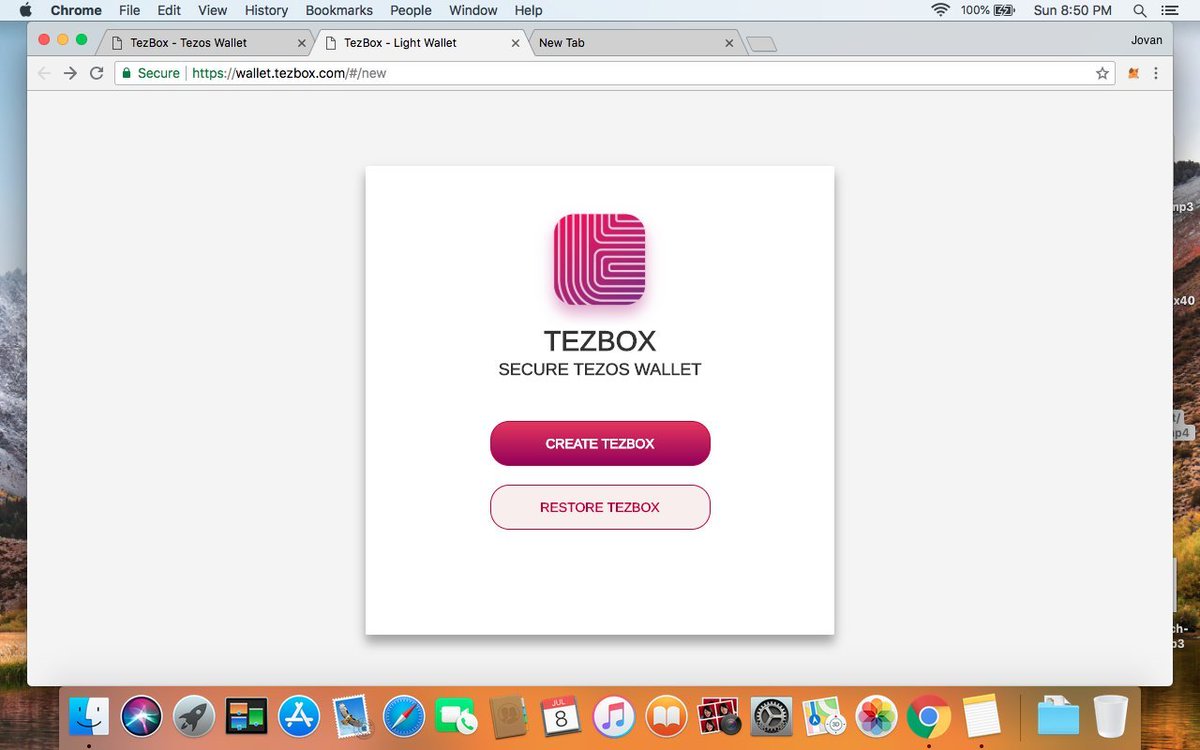

Having a sight on Tezbox

A genuine illustration of those advanced payment techniques is that the mobile wallet. this is frequently a tezbox wallet that is contained inside the mobile of a private and might be wont to make payments for administrations and products. It works during a basic yet successful and secure way. a private who possesses a mobile will either download the mobile wallet application, or utilize the gave application that is contained on their sim card. they will at that point register for the appliance utilizing an identification document. After this interaction is finished, they will store assets into the wallet by keeping genuine assets with an account worked by the specialist co-op. At the point when payments are comprised of this digital wallet, reserves are deducted from the specific account registered under the client’s credentials.

Mobile cash are frequently utilized when shopping on the web. The assets are frequently utilized at stores online additionally as in making standard payments like service bills shopping for food, payments and various different stores and online applications. Having the possibility to utilize mobile cash as such a payment might be a decent and welcome other option. Clients of those applications will have the accommodation of paying for products and enterprises at whatever point they need to. This cycle of utilizing a mobile tezbox login wallet additionally saves individuals the time and energy that is identified with different kinds of payment. for example , making on the web payments is framed simpler and doesn’t need the usage of credit cards.

It are frequently useful to comprehend a touch bit about online exchange dealing with prior to beginning to accept this repayment structure. Payments gave on a web webpage are checked and approved continuously, which means the client should anticipate an affirmation showing everything experienced as wanted. such a handling requires an online vendor account, payment passage, coordinated wheel barrow , and an exchange structure. The vendor account is utilized by the preparing organization or bank to get confirmation from the credit supplier and move the assets into the provided shipper account. Online payment preparing requires a passage to safely send the client data to the acceptable bank. it’s gotten together with the pushcart and in this manner the provided exchange structure. The pushcart monitors client determinations all together that they are regularly populated into the shape . Entryways send the information after a client has tapped the submit button on the exchange page.

Accepting Online Payments: How Do These Components Work Together?

Incorporation of the previously mentioned parts makes a trustworthy arrangement for organizations anxious to accept online payments. What precisely happens once of these elements are set up? Initial, a client will examine the corporate site to search out things they need to get.