The global aerospace composites market features a highly consolidated vendor landscape, as reported by Transparency Market Research (TMR). The top three vendors in the global market accounted for 50% of the overall market share in 201y inve5. The dominance of these vendors could be on account of heavy investments made by these companies for research and development activities. Vendors in the global aerospace composites market are diversified in nature. They range from aerospace composites manufacturers, raw material suppliers, and downstream stakeholders.

Vendors in the global aerospace composites market are increasingly adopting backward and forward integration, in order to gain traction in the market. Additionally, vendors are leveraging o the leading trend of customization by offering application specific products. This is expected to give vendors a competitive edge over their rivals. Mergers and acquisitions are a key strategy that will be leveraged by vendors in this market in the coming years.

Prominent vendors in the global aerospace composites market are Hexcel Corporation, Huntsman International LLC, SGL-The Carbon Company, Cytec Solvay Group, and Toray Industries Inc.

TMR predicts that the global aerospace composites market, estimated to be worth US$11.5 bn in 2015 is anticipated to reach US$24.8 bn by the end of 2024. The global market is likely to exhibit a 9.1% CAGR over the forecast period of 2016 to 2024.

Request PDF brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=21086

The colossal demand from commercial, residential, and corporate sectors contributes to the healthy and growing demand in the floor walls and coverings segment of the market. Geographically, the global plasticizers market is anticipated to be led by Asia Pacific, with a 6.10% CAGR.

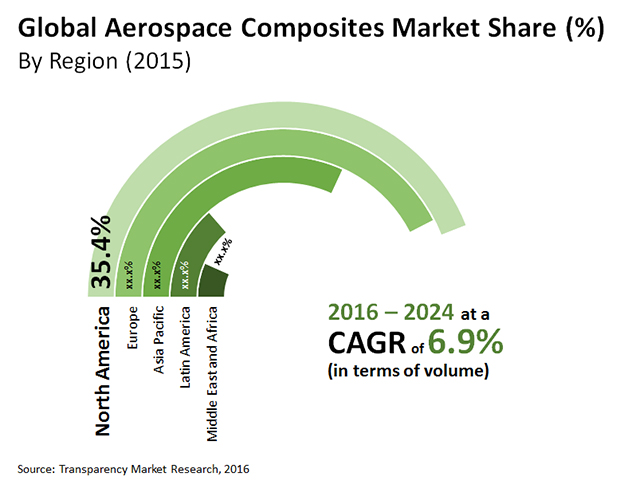

Among the product types, the segment of carbon fiber composites is forecasted to remain lucrative, thanks to a 53% volume share in 2015. North America is expected to be a dominant region in the global aerospace composites market. This could be accounted to the established presence of leading vendors in the region.

Demand for Cost Efficiency Drives Market

The aerospace industry is competitive in high price levels on a worldwide scale and encourages aircraft manufacturers to develop cost-effective aircraft. The weight of aircraft is a critical indicator of operating efficiency. This means the use of light weight and high-performance structural materials, such as composites, for the manufacturing of aircraft components, as the focus of leading aircraft producers such as Boeing and Airbus Group SE.

Request enquiry before buying:

https://www.transparencymarketresearch.com/sample/sample.php?flag=EB&rep_id=21086

Carbon fibers are a lightweight material among the different types of composites and offer a relatively higher strength. These features are ideal for the manufacture of aircraft because they improve commercial aircraft fuel economy and reduce operating costs. The world’s rapidly-growing aviation market is likely to promote the growth of new aircraft, which will in turn increase demand for carbon fiber composites to be produced in aircraft in the coming years, leading to growth on the aerospace composites market.

High Uptake of Autoclave Process to Emerge as Key Trend

Most composites are currently produced through the autoclave process, which uses pressurized vessels at high temperatures to manufacture composite materials. Out of Autoclave (OOA) is an alternative and more efficient process for the manufacturing of composites without the use of autoclaves in a closed mold, by pressurizing and heating. The OOA technology offers several advantages over autoclave technologies, such as lower production costs and increased material resistance. Thus, in the aerospace composites market, the shift to more effective production process is the major trend.

Request for custom research: https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=21086