Global Liquid Biofuel Market: Snapshot

Non-renewable energy sources like oil, petroleum gas, and coal are taken from profound inside the earth, and used to drive vehicles, heat structures, and produce power. Oil can likewise be utilized to make oil based synthetic compounds (petrochemicals), which are found in numerous regular things like the soles of your shoes or the plastic front of your school transport seat. The beneficial thing about petroleum derivatives is that they are very vitality thick, i.e., they contain a ton of vitality for each unit of volume. This implies non-renewable energy sources are truly adept at driving vehicles and producing heat. The not very great thing about petroleum products is that the earth has a restricted measure of them. This has created a massive demand for biofuels to cater to necessity of propulsion fuel. Owing to this demand the global liquid biofuel market is expected to grow substantially in coming years.

- The procedures that researchers use to transform biomass into biofuel can be pricey. Expensive substance responses. A synthetic response happens when molecules in a substance become revamped, prompting a compound change in the substance. A compound response can just continue once it has assembled enough energy. This base measure of vitality expected to begin the response is known as the activation energy. What’s more, some biofuel responses require unforgiving synthetic substances that can make their own ecological issues, leaving us directly back where we began as far as maintainability. These challenges can hamper the growth of global liquid biofuel market in future.

- Biofuels can assume a significant job in lessening carbon dioxide emanations. Fluid biofuels can be utilized as elective energizes for a wide range of interior ignition motors running on gas, diesel, or lamp oil. They can be utilized in traveler vehicles, trucks, boats, and planes. As of now, ethanol and biodiesel are the two normal kinds of liquid biofuels that are boosting the growth of global liquid biofuel market in future.

Liquid Biofuel Market Gain Momentum amidst Environmental Concerns and Depleting Natural Resources

Developments in the liquid biofuel market have been largely driven by some glaring modern-day challenges, including global warming, climate change, volatility in crude oil prices, and depletion of fossil fuels. Moreover, due to the burdening impact of these challenges, research & development activities have gained a significant amount of traction in the biofuel market. The development of biomass-derived fuels and energy resources continues to gain worldwide recognition and thus, the popularity of liquid biofuels is growing at a rapid pace. Still at a nascent stage, the liquid biofuel market is expected to enter its golden era during the forecast period. One of the leading factors that is expected to propel the demand for liquid biofuels in the coming years is the role it plays in minimizing the emission of toxic greenhouse gasses and carbon emission.

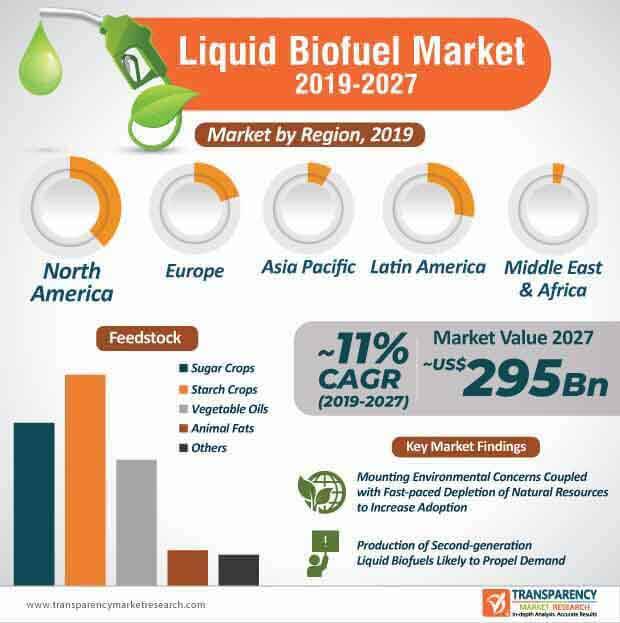

As core sectors around the world continue to find different ways to reduce their carbon footprint, biofuels have started to gain significant recognition, owing to their lower environmental footprint. Moreover, due to their biodegradable nature, biofuels have emerged as a sustainable alternative for conventional and fossil fuels. Over the past decade, government bodies across the world have implemented effective policies for liquid biofuel development for local as well as cross-border market players. At the back of these factors, the global liquid biofuel market is expected to reach the market value of ~US$ 295 Bn by the end of 2027.

Request a sample to get extensive insights into the Liquid Biofuel Market

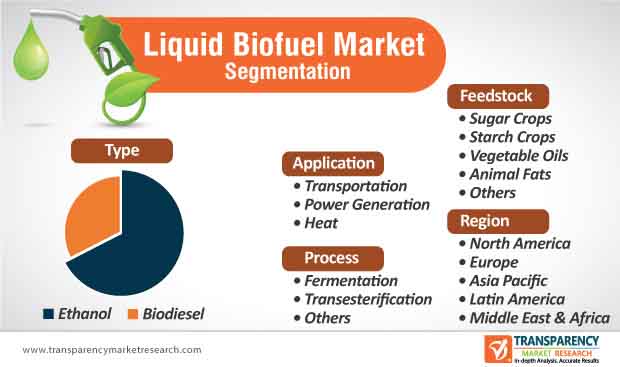

Adoption of Ethanol to Remain Higher than Biodiesels

The demand for fossil derivate fuels continues to scale new heights due to rising concerns over economic instability, climate change, and long-term sustainability of fossil resources. As a result of these concerns, the production of alternative chemicals and fuel, including liquid biofuels, is moving in the upward trajectory– a trend that is likely to continue during the assessment period. Ethanol has emerged as an excellent biofuel that is expected to reduce the overall gasoline consumption, especially in the transportation sector. The uptake of ethanol as a biofuel has thus gained notable traction in the past few years, and as per the analysts at the Transparency Market Research, the adoption of ethanol will remain higher than that of biodiesels during the forecast period. Within the transportation space, bioethanol is one of the most widely used liquid biofuels due to which, the number of countries with robust renewable energy policies witnessed a considerable rise between 2012 (56) and 2015 (66).

To understand how our report can bring difference to your business strategy, Ask for a brochure

Due to these policies, the global production of bioethanol has grown at an impressive pace, primarily driven by the U.S. and Brazil– major producers of bioethanol across the world. At present, bioethanol is primarily derived from starch or sugar-feedstock and classified as 1G bioethanol. In recent times, the interest in cellulosic biomass has received considerable attention in the production of bioethanol, owing to low costs, availability, and advent of cost-effective production technologies. Significant research has been carried out to enhance the efficiency of the production process in the biofuel market.

Companies Explore Potential of Developing Biofuel from Various Feedstock

Sensing the growing adoption of liquid biofuels, companies operating in the current liquid biofuel market are increasingly allocating resources in research activities to investigate the potential of developing biofuels from various feedstock. Although starch and sugar crops are expected to remain the most popular feedstock choice, other feedstock alternatives, including animal fats and vegetable oil are gradually gaining spotlight. Most recently, corn has emerged as an ideal choice for the production of ethanol, due to its large-scale availability and relatively easier conversion to ethyl alcohol and high-starch content. As awareness regarding the potential benefits of biofuels increase, the demand is set to grow at an impressive rate in the coming years. Biofuel technologies around the world continue to advance at a rapid pace due to which, the production of liquid biofuels has gained considerable traction. The second generation of bioethanol produced from cellulosic hydrolysate is gradually entering the liquid biofuel market and gaining noteworthy popularity due to low impurities and other favorable properties.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Liquid Biofuel Market

Analysts’ Viewpoint

The global liquid biofuel market is expected to expand at an impressive CAGR of ~11% during the forecast period. Some of the major factors that are projected to drive the liquid biofuel market during the assessment period include mounting environmental problems, fast-paced depletion of natural resources, regulatory policies pertaining to the use of biofuels in different countries, and low environmental footprint of liquid biofuel applications. Companies involved in the current market landscape should focus on research and explore the potential of different feedstock to develop liquid biofuels to enhance their market presence.

Transportation will largely remain the major application area of liquid biofuel followed by power generation.

Liquid Biofuel Market: Overview

- Biofuels can play an important role in reducing carbon dioxide emissions. Liquid biofuels can be used as alternative fuels for all types of internal combustion engines running on gasoline, diesel, or kerosene. They can be used in passenger vehicles, trucks, ships, and airplanes. Currently, ethanol and biodiesel are the two common types of liquid biofuels.

- Biodiesel is made from vegetable oils, animal fats, or greases such as recycled restaurant grease, while ethanol is obtained from natural sources such as sugarcane, maize, and corn

Biofuel Promotion and Renewable Energy Targets Drive Liquid Biofuel Market

- The Renewable Energy Directive (RED) II set by the EU Council and the European Parliament mandates that 6.8% of transportation fuels must be derived from renewable sources such as advanced alternative fuels (biofuels) and renewable electricity generation. This is expected to contribute to the overall goal of achieving 20% of the energy mix by 2020.

- China has been promoting the production and consumption of biofuels. The Government has set the production target of 12.7 billion liters of ethanol and 2.3 billion liters of biodiesel by the end of 2020

- The Government of Brazil aims to reduce domestic emission of GHG by 37% by 2025 and 43% by 2030. In line with this, it launched the RenovaBio Program in December 2016. The program was instituted as part of the ‘National Biofuels Policy’ in December 2017. This is anticipated to positively influence the global liquid biofuel market.

Volatility in Prices of Crude Oil Boosts Liquid Biofuel Market

- Prices of crude oil are affected by events that can potentially disrupt the supply of oil and gas. These include geopolitical and weather-related issues. Geopolitical events is a major factor that leads to uncertainty about supply or demand for oil and gas. This can result in higher volatility in prices of oil and gas.

- The Middle East accounts for major share of oil and gas production & supply. The region is experiencing instability due to political issues. Prices of oil and gas have been rising steadily in the market.

- Volatility in prices of oil directly effects the production of oil and gas. This is estimated to propel the liquid biofuel market during the forecast period.

Expansions, Acquisitions, and New Contracts in Liquid Biofuel Market

- In May 2019, United Airlines strengthened its reputation as the world’s most environmentally conscious airline by renewing its contract with the U.S.-based World Energy. United Airlines agreed to purchase up to 10 million gallons of cost-competitive, commercial-scale, sustainable aviation biofuel over the next two years.

- In July 2019, Renewable Energy Group, Inc., the leading producer of advanced biofuel, expanded its business by opening its first fueling station in Seneca, Illinois, the U.S. The station is projected to provide cleaner fueling options to the community in Seneca, Illinois, the U.S.

- In January 2019, ExxonMobil Corporation and Renewable Energy Group (REG) announced signing of a joint research agreement with Clariant to evaluate the potential use of cellulosic sugars from sources such as residues and agricultural waste to produce biofuel

More Trending Reports by Transparency Market Research – https://www.prnewswire.co.uk/news-releases/global-artificial-lift-systems-market-to-earn-revenue-worth-us-12-3-bn-by-2027-growing-at-a-cagr-of-5-0-over-2019-to-2027-transparency-market-research-853459071.html

Starch Crops to Offer Lucrative Opportunities

- Based on feedstock, the global liquid biofuel market can be segmented into sugar crops, starch crops, vegetable oils, animal fats, and others. The starch crops segment constituted major share of the global liquid biofuel market in 2018. Starch-based feedstock includes grains such as corn or wheat; and tubers such as potatoes and cassava.

- Starch crop is the primary feedstock for ethanol production. Most of the ethanol in North America is produced from corn, which is one of the lower-yield feedstock. Corn produces about 400 gallons of ethanol per acre. The U.S. Government subsidizes the production of corn. Therefore, many countries across the globe find it cheaper to import corn from the U.S.

North America Dominates Liquid Biofuel Market

- North America dominated the global liquid biofuel market in 2018. The liquid biofuel market in the region is likely to expand at a significant pace during the forecast period, due to supportive government regulations. Under the Energy Independence and Security Act of 2007, the Renewable Fuel Standard mandates that 36 billion gallons per year (bg/y) of biofuels needs to be produced by 2022. North America produced around 40% of the global ethanol production in 2018.

- The U.S. dominated the liquid biofuel market in North America in 2018. According to the 2019 U.S. Biodiesel Plant Production Capacity Report, 102 biodiesel plants are operational in the country with 2.6 billion gallons/year of biodiesel production capacity. More than half of the nation’s biodiesel production capacity is in the Midwest region, led by states such as Iowa, Missouri, and Illinois.

- In terms of revenue, Europe held vital share of the global liquid biofuel market in 2018. Implementation of stringent government regulations regarding the renewable energy targets is driving the liquid biofuel market in the region. Europe is the largest biodiesel producer and consumer in the world. The region produces around 35% of the global biodiesel production. Germany dominated the liquid biofuel market in Europe. The country is the largest producer of biodiesel in the region. It produced 3,100 million liters of biodiesel in 2018.

- In terms of production, Latin America was the second-largest region of the global liquid biofuel market in 2018. The region produced 43 billion liters of liquid biofuel in 2018. Brazil is the major country of the liquid biofuel market in Latin America.

- Middle East & Africa held minimal share of the global liquid biofuel market in 2018

Request for covid19 Impact Analysis – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=76579

Highly Competitive Liquid Biofuel Market

- The global liquid biofuel market is highly fragmented, with the presence of large numbers of local, regional, and global players

- Key players operating in the global liquid biofuel market are

- Fulcrum BioEnergy

- Archer Daniels Midland Company

- RB FUELS

- POET, LLC

- Cargill

- Incorporated

- Bangchak Corporation Public Company Limited

- Renewable Energy Group, Inc.

- Bunge

- Green Biologics Limited

- CropEnergies AG

- Algenol

- Emami Agrotech Limited

- Eniven Group

- World Energy Alternatives LLC

- Bio-Oils Energy