Virtual Payment (POS) Terminals Market: The March towards a ‘Cashless Future’

With the recent trend of going ‘cashless’, there has been a subsequent rise in the adoption cashless digitalized payment systems. Small businesses, in particular, will serve as a vital growth platform for virtual Point of Sale terminals. This is mainly because they refrain from investing in complex hardware and systems, making virtual terminals an indispensable resource for accepting online payments. Virtual terminals have gained their very own eminence with advancements in mobile applications, and the mounting need to enhance merchant and consumer interactions. Businesses are focusing on adapting to the new digital consumer behavior by replacing traditional payment systems with virtual payment (POS) terminals.

However, with intensified competition in global markets, companies are facing challenges in terms of meeting the rising customer needs for safety and security in processing transactions. Manufacturers have used this restraint to their benefit by integrating data encryption or tokenization into their virtual payment platforms, thereby enhancing security in payment processes. These strides towards a cashless future have compelled TMR analysts to conduct an in-depth analysis of the virtual payment (POS) terminals market. In its new study, TMR highlights the key drivers and changes in consumer behavior that are unlocking growth opportunities in the industry.

Purchase our Premium Research Report At:https://www.transparencymarketresearch.com/checkout.php?rep_id=63762<ype=S

Walk through the Market’s Evolutionary Timeline

The payments industry is a complex space that has been seeing spinning transition, with numerous companies offering advanced payment options to climb up the digital space. Electronic payment terminals existed long before the Internet era, with retailers increasingly adopting solutions from hardware manufacturers such as Ingencio and Hypercom. The landscape of terminal payments completely transformed with the emergence of the internet, as it led to the inundation of new online POS terminals. This technology has seen tremendous evolution from the launch of TWINPOS G Series in 2011 to the development of TWINPOS G5100Li POS models in 2018.

With a ballooning e-Commerce industry and the emergence of multiple payment gateways, the virtual payment (POS) terminals market is anticipated to grow at a promising CAGR of ~ 28%, and reach the mark of ~ US$ 78 Bn by the end of the forecast period.

Want to know the obstructions to your company’s growth in future? Request a PDF sample here

Key Trends that are Worth Paying Attention To

Digital Wallets to Remain at the Forefront

Not only do digital payment systems offer a speedy shopping experience, but they instill a sense of security among consumers by eliminating the need to enter credit or debit card details over and over again. Moreover, digital wallet companies are increasingly providing digital wallet solutions that are easy to integrate. The e-Commerce sector, in particular, has proven to be the focal point for the growth of digital wallet solutions. Reduction in shopping cart abandonment due to cumbersome purchasing procedures is another reason for the growing consumer inclination towards digital wallets.

Get More Press Release by TMR: https://www.prnewswire.com/news-releases/incidents-of-irreparable-damage-in-world-scale-sporting-events-underscores-growth-in-sports-protective-equipment-market-tmr-301264205.html

Winning Imperatives to Circumvent Growth in the Market

Offering Loyalty Rewards to Enhance Customer Retention

Merchants are tying loyalty to the use of mobile wallets to drive consumer attention. Loyalty rewards have become the new currency in the space of virtual payment. Rising consumer interest in mobile payments is directly proportional to the value received from using these wallets. In a bid to retain customers, mobile wallet companies such as Google Pay and Amazon are offering loyalty rewards in the form of ‘free stuff’ and ‘discounts’ to attract new customers and retain the existing ones.

Bolstering Investments in Developing Regions and Untapped Markets

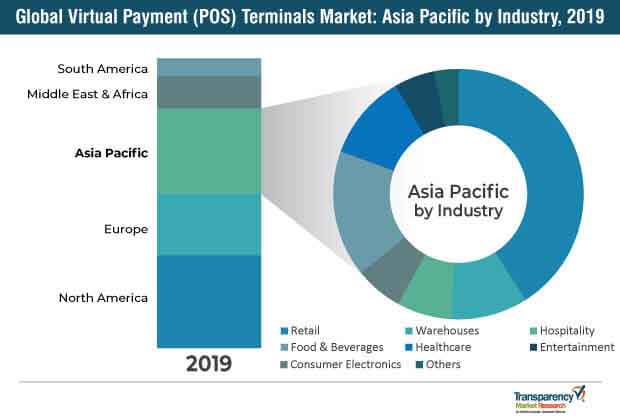

With the rise in digitalization, numerous countries in Asia and South America highly demand virtual payment terminals across end-use sectors. The extensive use of online shopping platforms and advancements in digital systems are key factors driving the use of virtual payment (POS) terminals in developing regions. Moreover, countries such as India and China are shifting towards a robust digital economy, as cashless payment systems take center stage. Asia Pacific alone accounted for ~ 27% of the virtual payment (POS) terminals market share in 2018, and is expected to reach ~ 48% by 2027. South America remains an untapped market, presenting a significant market space for growth, as the competition is low in this region.

A Glance at the Competitive Landscape

The virtual payment (POS) terminals market features a highly fragmented vendor landscape, with a large number of players competing to develop advanced virtual payment (POS) terminals. Competitive rivalry among players is mainly characterized by new alliances and partnerships to enhance their stronghold in the global virtual payment (POS) terminals market.

Apart from this, new product launches and business expansion are the key winning strategies deployed by players in the virtual payment (POS) terminals market. For example, in April 2018, Samsung Electronics America Inc., a subsidiary of Samsung Electronics, announced its plan to relocate its North Texas campus to Legacy Central in Plano, Texas, U.S. Further, in March 2019, PAX Technology partnered with Secure TablePay to introduce a new facility – Pay-at-the-Table Experience – to restaurants across the U.S.

Leading players in the virtual payment (POS) terminals market include

- PAX Technology

- Ingenico Group

- Shenzhen Xinguodu Technology Company Ltd.

These players have a strong global presence, as they have invested significantly in expanding their virtual payment terminal manufacturing services. Prominent players such as VeriFone Systems Inc. and Fujian Newland Payment Technology Co., Ltd. also have a global presence. However, their market penetration is comparatively lower than the leading players in the virtual payment (POS) terminals market.

Emerging companies in the virtual payment (POS) terminals market include Panasonic Corporation, NCR Corporation, and Squirrel Systems. These companies are strengthening their presence by establishing new facilities and investing heavily in research and development activities to develop advanced software. For instance, in May 2018, Panasonic Corporation launched integrated mobile POS solutions for the Toughpad FZ-G1 rugged tablet and handheld devices for retail and hospitality industries.

Contact us:

Transparency Market Research

State Tower,

90 State Street, Suite 700,

Albany NY – 12207,

United States

Tel: +1-518-618-1030 Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com

https://todaysmarkettrends.wordpress.com