- Third party risk management is the process of evaluating and controlling risk connected with outsourcing to a service provider or third party vendors. Companies are more dependent on third party solutions and service providers to ensure short delivery timelines, and faster productions outcomes at lower cost.

- Companies expanding business operations with the help of a third party get exposed to unpredicted risks.

- The main goal of a third-party risk management framework is to reduce cyber-attack, security incidents, or data breaches. The third party risk management also involves strategic risks, for instance, the organization may fail to meet its business objective because of a third-party vendor.

- A company should have proper periodic monitoring, planning, assessment and improvement to handle third party risk management.

Request for a sample:

Third Party Risk Management Market: Dynamics

Third Party Risk Management Market: Key Drivers

- Cybersecurity threats are increasing day by day. A third party risk management structure helps systems and networks to be protected.

- Third party vendors open the door to unexpected risks and weaknesses that can have destructive significances including reputational, regulatory, and financial impacts.

- Third party risk management provides benefits such as analyzing the risk related to third party service provider risk adoption and also allows to focus on the core business, and can improve integrity, and confidentiality of the company.

- Third party risk management platforms helps end user industries to analyze and detect the risk associated with investing or adopting third party services for different business process.

Impact of COVID-19 on Third Party Risk Management Market

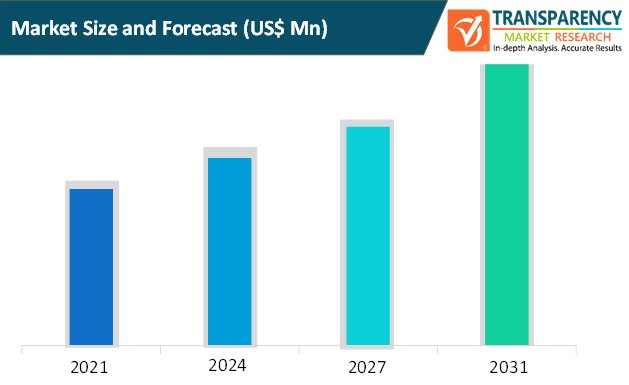

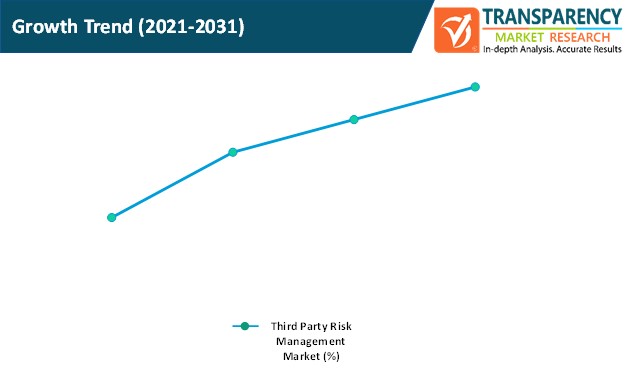

- Growing cases of COVID-19 across the world is causing economic slowdown.. Established countries are hugely affected by the pandemic. Growth of the third party risk management market is expected to increase during the forecast period.

PreBook Now:

https://www.transparencymarketresearch.com/checkout.php?rep_id=82371<ype=S

North America to Hold a Major Share of the Third Party Risk Management Market

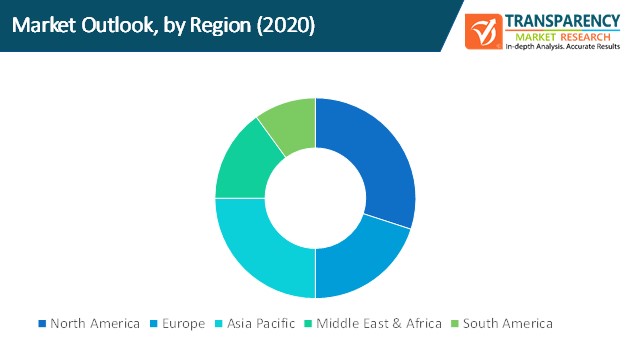

- In terms of region, the global third party risk management market can be divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America

- North America dominated the third party risk management with the largest share mainly because of developed economies such as the United States and Canada. The U.S. is a key market in the region due to early adoption of third party risk management solutions.

- The third party risk management market in Asia Pacific is likely to expand at a speedy pace throughout the forecast period. Increase in the number of startups and small size companies in Asia Pacific is leading to the growth of the third party risk management market.

Third Party Risk Management Market: Competition Landscape

Several local, regional, and global players are active in the third party risk management market with a significant presence. Hence, the market is fragmented in nature. Speedy technological developments have created important opportunities in third party risk management market. Market players are progressively focusing on developing inventive and progressive solutions in order to improve their offerings and market reach.

Ask for brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=82371

Key Players Operating in the Third Party Risk Management market Include:

- RapidRatings

- Optiv

- Aravo

- One trust

- Galvanize

- Prevalent

- RSA

- Genpact

- Metricstream

- Deloitte

- KPMG

- Bitsight Technologies

- Ernst & Young

- PwC

- ProcessUnity

- Venminder

- Resolver

- Naevex Global

- Riskpro

- Sai Global

TMR’s Latest News Publication –