Well Testing Services Market – Snapshot

Well testing services, or well work, is an operation carried out on an oil or gas well before/during its drilling span. It alters the state of the well or well geometry, provides well diagnostics, or manages the production of the well. Well testing services provide the ability to safely enter a well in order to carry out numerous tasks other than drilling. The history of well testing services dates back to the 1800s, when the technology was first developed to afford re-entry into wells with alternatives to drilling well control systems and rigs for delivery of non-drilling services.

Read report Overview-

https://www.transparencymarketresearch.com/well-testing-services-market.html

New oilfield discoveries to boost investment in well testing services

Oil & gas field/well operators are looking for efficient, cost-effective, and safe methods that provide old wells a new lease of life with continued production and maximized recovery. This is anticipated to offer substantial growth opportunities to the well testing services market in the near future. Year-on-year increase in new oilfield discoveries has augmented the demand for well testing services.

Request Brochure @

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=48234

Well testing services to gain momentum from offshore E&P investments

Investment in well testing services is shifting from onshore to offshore E&P activities. Offshore well testing services are more lucrative than onshore well testing services for various service providers. Downhole is used to measure accurate pressure even under hostile conditions. Different types of downhole testing tools include slip joints, circulating and reversing valves, downhole tester valves, downhole safety valves, downhole sampling, downhole pressure gauges, retrievable packer, pressure test and fill-up valves, jars and safety joints, and testing packers. Downhole sampling is also used to recover formation fluid samples at reservoir conditions with a suite of pressure compensating equipment that allows controlled, uncontaminated sampling without flashing. Conventional drill stem testing (DST) is a proven and cost-effective means of evaluating a well. These tools are used as cased hole test tools and open hole test tools.

REQUEST FOR COVID19 IMPACT ANALYSIS –

https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=48234

Tools used in cased hole testing include circulating valves, tester valves, packers, and a range of accessory tools. Open hole testing tools comprise packers, valves, safety joints, and testers. Data acquisition services/real time monitoring is used to ensure reliability, accuracy, and easy access to information as it is being measured for well testing. Data acquisition is one of the most important objectives of well testing. Equipment used to perform a well test has improved technologically over the years; however, the need to acquire data remains the same.

Volatility in crude oil prices to restrain growth

The outlook of well testing services is highly dependent on the prices of crude oil and renewable-based power. Several E&P projects have come to a standstill due to the decline in prices of crude oil, thereby hampering the demand for well testing services across the globe. This has triggered investments in the renewable energy business owing to government support and regulations pertaining to carbon emissions. High investments in solar and wind power technologies have shifted the focus toward clean energy. This has adversely affected the global well testing services market. However, stability in prices of crude is expected to provide lucrative opportunities to the global well testing services market for new discovery as well as existing oil wells.

Developments & innovations in terms of product and technology

In July 2018, SGS and Baker Hughes, a GE company, announced a strategic alliance agreement (SAA) for the joint deployment and commercialization of the latter’s real-time software and sensor-based predictive corrosion management (PCM) solution. On February 28, 2018, Oil States International, Inc. announced that it had acquired Falcon Flowback Services, LLC, a full service provider of flowback and well testing services for the separation and recovery of fluids, solid debris, and proppants used during hydraulic fracturing operations. Falcon Flowback Services, LLC is expected to provide additional scale and diversity to Oil States International, Inc.’s completion services well testing operations in key shale plays in the U.S. The acquisition was valued at around US$ 85 Mn. The acquisition has helped the company expand its well testing footprint and equipment offerings.

In February 2018, Schlumberger Limited launched the. The motion-compensated testing services tower saves time and minimizes risk for deepwater operations by enabling precise perforating and other CT, wireline, and slickline operations concurrent with the drilling activity. It is designed specifically to fit on the limited-space deck of a tension-leg platform and compensate for moving seas. It can skid easily from one well slot to another and convey a long string of perforating guns even while working below the drilling mast equipment package (MEP). In January 2018, Halliburton was tasked with developing and delivering an integrated well testing services campaign, plugging 20 wells in an offshore field off Norway, at the lowest cost possible. This included providing project management, engineering, personnel, equipment, and services. A creative, customized solution was needed to produce a low-cost, effective solution. Considerable collaboration with the oil & gas customer and detailed well analysis is likely to be needed to determine the appropriate solution in order to meet project requirements at the lowest cost possible.

In October 2017, TechnipFMC plc announced it had entered into an agreement to acquire Plexus Holding plc’s wellhead exploration equipment and services business for jack-up applications. The acquisition is expected to further extend and strengthen TechnipFMC plc.’s position in exploration-drilling products and services. In November 2017, Wintershall Holding GmbH, an oil & gas exploration company, deployed Emerson’s latest product Roxar Downhole Sensor System in the Maria offshore field in Norway. The new product by Emerson is anticipated to improve well integrity monitoring and offshore safety, thereby expanding its business portfolio in Europe.

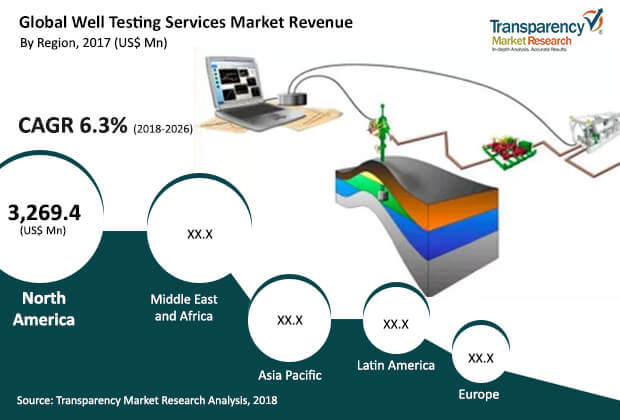

North America market to expand at fast pace in terms of demand

In terms of value, North America dominated the well testing services market in 2017, owing to the presence of a large number of well testing service providers in the U.S. and Canada and increase in E&P activities. The U.S. had more than 850 rigs, while Canada owned more than 200 rigs in 2017. North America accounted for more than 45% share of the market in 2017. Offshore well testing services are gaining momentum in North America, owing to the rise in investments in offshore oil & gas wells. Exploitation of shale and other unconventional resources is likely to boost the demand for well testing services in the U.S.

Highly competitive market with dominance of top players

The global well testing services market is highly fragmented; large numbers of local and international players operate in the market. Players with technical expertise and rich experience dominate the market. Key players operating in the well testing services market are Schlumberger Limited, HELIX ESG, Halliburton, Expro Group, Weatherford International Plc., SGS S.A., Tetra Technologies, Inc., TestAlta, CETCO Energy Services, Oil States International, Inc., PTS Production Technology & Services Inc., Abraj Energy Services SAOC, Emerson Automation Solutions, Integra Group, and TechnipFMC plc.