Usage-based insurance refers to a type of auto insurance, which utilizes the in-vehicle communication systems to keep a track of driving behavior and mileage. Use of telematics systems gives precise and accurate feedback of the driving patterns and safety practices of the driver. Telematics refers to a method of vehicle monitoring, which combines on-board diagnostics with the GPS system to track behavior of the vehicle. Such a technology enables the insurance companies to alter the insurance cost based on the risk thus estimated.

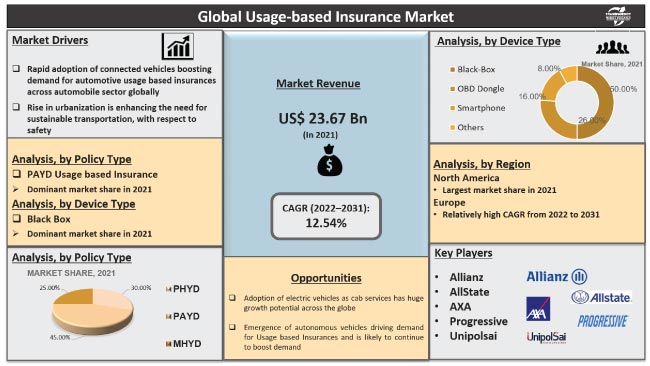

Allstate Insurance Company, State Farm Mutual Automobile Insurance Company, UnipolSai Assicurazioni S.p.A, Insure The Box Limited, Intelligent Mechatronic Systems Inc, and Allianz SE are some of the companies dominating the global usage-based insurance market.

Transparency Market Research has come up with an all-inclusive study on the global usage-based insurance market, for the period 2019 to 2027. The report predicts that the global usage-based insurance market is likely to clock a staggering 30% CAGR over the period of review. The market is estimated to reach US$ 200 Bn through 2027.

Get Sample Copy of the Report to understand the structure of the complete report (Including Full TOC, Table & Figures): https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=52104

With the Growing Confidence and Awareness, North America is Likely to Lead the Market

The global usage-based insurance market is divided into the key regions of North America, Latin America, Asia Pacific, the Middle East and Africa, and Europe.

It is prophesized that the North America usage-based insurance market is likely to exhibit huge potential in terms of revenue. The lucrativeness of the region lies in the large number of vehicles plying on the road. In addition to that, growing awareness and confidence about the use of usage based insurance is likely to bolster its regional demand in the years to come. Europe, too, is likely to follow the footsteps of North America, as the usage-based insurance market gathers momentum in Europe as well. Increased innovation in the automotive industry of Europe is likely to pave way for promising growth of the market in Europe in near future.

The usage-based insurance market is likely to witness a promising future in the Middle East and Latin America as well. The market is estimated to clock an impressive growth rate in the region over the timeframe of assessment due to increased adoption of telematics systems in the region. This has encouraged adoption of the insurance telematics programs across South Africa, Argentina, and Brazil.

Growing Interest of Insurance Providers likely to Support Growth of the Market

The evolution of the automotive usage based insurance industry is directly linked with the advancement of the automotive industry. The demand for automotive insurance is directly proportional to the sale of vehicles fitted with connected car and telematics services. In addition to that, increased focus on remote diagnostics by the providers of insurance is likely to encourage growth of the global usage-based insurance market. Adoption and use of advanced on-board communication devices to facilitate real-time connectivity between insurance providers and the vehicle helps in the diagnosis of breakdown issues.

The expansion of the global usage-based insurance market growth is ascribed to the growing popularity of usage-based insurance solutions amongst the insurance enterprises. In order to maximize profitability, insurance providers are taking up this option, which enables them improve pricing models, increase revenue, and regulate cost of claim. This factor is likely to trigger growth of the global usage-based insurance market in the forthcoming years.

The information shared in this review is based on a TMR report, bearing the title, “Usage-based insurance market (Policy Type – Pay-How-You-Drive (PHYD), Pay-As-You-Drive (PAYD), and Manage-How-You-Drive (MHYD); Device Type – Black Box, OBD Dongle, and Smartphone; Vehicle Type – Passenger Vehicle and Commercial Vehicle) – Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2019 to 2027

Request For Covid19 Impact Analysis Across Industries And Markets – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=52104

The global usage-based insurance is segmented based on:

Policy Type

- Pay-How-You-Drive (PHYD)

- Pay-As-You-Drive (PAYD)

- Manage-How-You-Drive (MHYD)

Device Type

- Black Box

- OBD Dongle

- Smartphone

Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Region

- North America

- US

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- U.K.

- Rest of Europe

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

- Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Customization of the Report: This report can be customized as per your needs for additional data or countries. – https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=52104

Related Reports Press-Release –

- https://www.prnewswire.com/news-releases/global-smoking-cessation-and-nicotine-de-addiction-market-to-expand-at-a-cagr-of-4-5-over-2018-to-2026–reaching-us-13-6-bn-by-2026-transparency-market-research-300998418.html

- https://www.prnewswire.com/news-releases/global-shared-mobility-market-to-grow-at-a-cagr-of-8-over-the-period-between-2018-and-2026-reaching-a-value-of-us-608-bn-by-2026-transparency-market-research-300998575.html

Contact

Transparency Market Research

State Tower,

90 State Street,

Suite 700,

Albany NY – 12207

United States

USA – Canada Toll Free: 866-552-3453

Email: [email protected]

Website: https://www.transparencymarketresearch.com