U.S. Pharmaceutical Plastic Bottles Market: Snapshot

The U.S. market for pharmaceutical plastic bottles derives much of its growth by addressing the growing sustainability concerns by increasing the recycling rate of plastics and lowering the environmental impact in the pharmaceutical industry. The advancements in the technology has emerged as the key growth driver of this market. Apart from this, the rising application of plastic bottles in solid and liquid oral medications is also adding to the market’s growth significantly.

In addition to this, the growing popularity of plastic bottle, owing to the convenience, safety, and security they offer, is likely to fuel the demand for pharmaceutical plastic bottles in the U.S., leading to a phenomenal rise in this market over the next few years. However, the eco-friendly substitutes for PE and PET, such as glass, metal, and sugarcane, which is also a renewable material, may limit this demand to some extent and hamper the growth of the U.S. pharmaceutical plastics bottles market in the years to come.

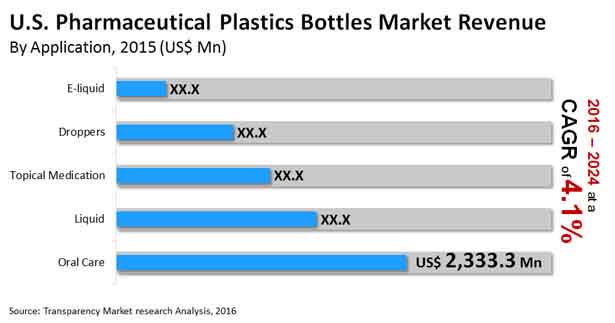

The U.S. market for pharmaceutical plastics bottles presented an opportunity worth US$6.74 bn in 2016. Analysts expect it to progress at a CAGR of 4.10% between 2016 and 2024 and reach a value of US$9.28 bn by the end of 2024.

Planning to lay down future strategy? Perfect your plan with our report brochure here https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=19331

Demand for Packer Bottles to Remain High in U.S. Pharmaceutical Plastics Bottles Market

Packer bottles, liquid bottles, dropper bottles, and various other types of bottles, such as Boston round bottle and bullet are the key products available in the U.S. pharmaceutical plastic bottles market. The packer bottles segment is leading the overall market with a share of nearly 50% and is expected to retain its dominance over the next few years due to the rising demand for customized pharmaceutical plastic packer bottles. Liquid bottles, however, is likely to witness a huge leap in demand in the near future, thanks to the retention of drugs content.

E-liquid, liquid, oral care, droppers, and topical medication are the prime application areas of pharmaceutical plastic bottles in the U.S. These bottles are likely to find a higher usage in oral care and topical medications than other application areas over the next few years.

Pharmaceutical Companies to Continue to Lead Pharmaceutical Plastic Bottles Consumption in U.S.

Pharmaceutical companies, chemical companies, pharmaceutical packaging companies, healthcare centers, and compounding pharmacies are the main end users of pharmaceutical plastic bottles in the U.S. Among these, the demand from pharmaceutical companies is much higher than other end users. Analysts expect this scenario to remain so, thanks to the expansion of healthcare industry and the rising uptake of plastic material for packaging. The healthcare centers are also projected to experience an increase in the demand for pharmaceutical plastic bottles in the near future.

Looking for exclusive market insights from business experts? Request a Custom Report here https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=19331

The U.S. market for pharmaceutical plastics bottles exhibits a highly fragmented and a competitive landscape. At the forefront of this market are Gerresheimer AG, AptarGroup Inc., Berry Plastics Group Inc., Amcor Ltd., Alpha Packaging, COMAR LLC, Drug Plastics, O. Berk Co. LLC, Pretium Packaging Corp., and Tim Plastics Inc.