Polyvinyl Chloride Market: Improved Properties of PVC to Offer Opportunities in the Healthcare Sector

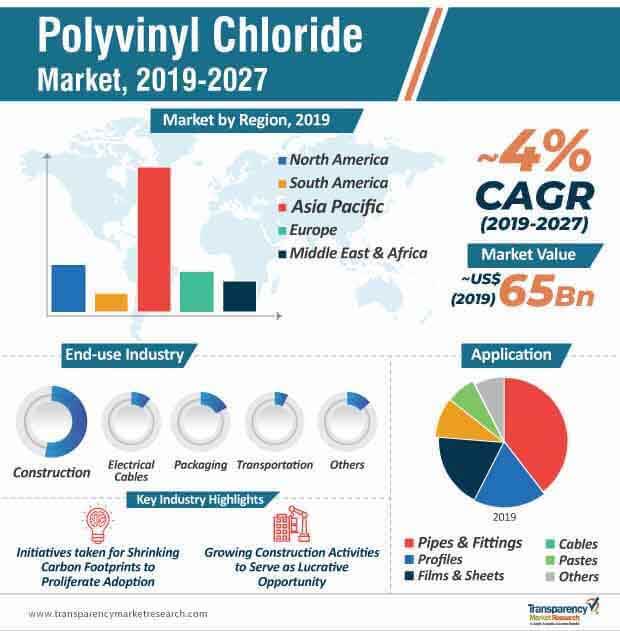

Volatility in the prices of chlorine, ethylene, and acetylene, used for the production of polyvinyl chloride (also known as PVC), fail to seize the steady gait of the PVC market. Sales in the polyvinyl chloride market are envisaged to arrive at a value tantamount to ~US$ 88 Bn by 2027, as found by a recently published study by Transparency Market Research (TMR). Majorly driven by construction, automotive, and packaging industries, the availability of advanced grades is a key success factor catalyzing revenue of the polyvinyl chloride market from the electrical cables segment.

As the world looks at the mounting costs of energy, coupled with the debatable use of polyvinyl chloride, given its environmental implications, PVC market players resort to R&D activities to focus on the quality of polyvinyl chloride. The customer-centric focus of polyvinyl chloride manufacturers is unlocking new avenues to cater to specific needs of end-use industries through surface modification techniques. Research has also identified healthcare as a budding consumer of polyvinyl chloride, owing to its inherent biocompatible and sterile features that are essential for manufacturing medical devices.

To gauge the scope of customization in our reports Ask for a Sample

All-in-all, market players can look at a steady adoption rate of polyvinyl chloride. But they also often find themselves seeking an answer to – Can the toxicity of PVC impact its adoption rate?

How Impactful is the Toxicity Factor in Limiting Growth of the PVC Market?

Despite a broad array of influencers boding well for sales, the toxic fumes that PVC emit when it is being melted or heated does raise environmental concerns. With the advent of 3D printers and increasing use of PVC during the prototyping and manufacturing of products, the emission of hydrogen chloride fumes is said to have an adverse impact on human health. Besides this, the material is a form of plastic, which has disposal issues. However, the polyvinyl chloride market observes the dawn of the circular economy, which is likely to beat the fickle raw material prices, alongside keeping disposal concerns at bay. That being said, the emission of toxic fumes during the manufacturing of other products can, to some extent, pose as a challenge to the growth rate of the PVC market, which market players can focus on to improve the sustainability aspect of their businesses.

Get an idea about the offerings of our report from Report Brochure

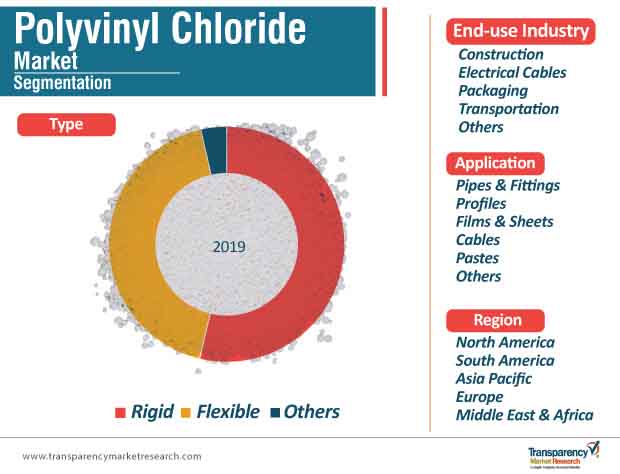

PVC Market: End Users’ Stance on Types of Polyvinyl Chloride

Though the rigid type of PVC is more difficult to install as compared to its flexible counterpart, findings of the report have collected a different take of end users. The rigid material has a wider consumer base, and it accounts for ~53% of the overall market share. Given its high tensile strength, it is highly rated for underground construction activities. The rigid property also makes it difficult for termites and rodents to chew PVC-based products, which, in turn, saves the product from the impact of time. As a sterile environment becomes a priority, flexible material often substitutes rubber for insulation used in homes, hospitals, schools, and similar locations. However, end users will continue to evince trust in rigid materials over flexible ones.

Looking for Regional Analysis or Competitive Landscape in Polyvinyl Chloride (PVC) Market, ask for a customized report

Polyvinyl Chloride Market: Analysts’ Viewpoint

Authors of the report envisage that ‘technology’ and ‘grades’ are going to be the key competitive parameters for market players. Market players with sound technical knowledge will be able to develop polyvinyl chloride of different grades and of superior qualities than the existing ones. With a large number of raw material suppliers, entry into the production competition is seen through forward integration, albeit at a slow pace.

Another crucial market highlight is the shift of manufacturers towards the development of biodegradable alternatives of polyvinyl chloride, by matching the price and performance of the standard material. In Asia Pacific, the growth of the polyvinyl chloride market is in tandem with the resurgence in construction activities. Since this material also suffices many automotive needs, China, Japan, and India have traditionally been crucial markets. With low threats of new market players and substitutes, market players in developed regions can scramble towards Asia Pacific to widen their consumer base and reap the benefits of cheap labor and low overhead costs.

Polyvinyl Chloride (PVC) Market: Description

- Polyvinyl chloride (PVC) is a widely used thermoplastic polymer, such as PET (Polyethylene Terephthalate) and PP (Polypropylene), made from the polymerization of vinyl chloride. It is an odorless solid plastic, which is naturally white and brittle.

- Rise in construction activities is expected to lead to rapid expansion of the residential and non-residential sectors in the near future. This, in turn, is expected to augment the demand for polyvinyl chloride products.

- The construction sector in the U.S. is estimated to expand at a rapid pace. Construction activities are anticipated to increase significantly in the southern states of the country in the coming years, and this is estimated to boost the PVC market in the U.S.

Key Growth Drivers of Polyvinyl Chloride Market

- The global construction market is at a tipping point, with 52% of all construction activity in emerging markets. The global construction market is expected to expand rapidly during the forecast period, with China and India contributing significantly. China overtook the U.S. to become a prominent construction market in 2010. The construction market in China is expected to expand at a rapid pace in the near future.

- PVC is primarily used in pipes & fittings and profiles in the construction sector. The global polyvinyl chloride market is primarily driven by expansion in the construction industry, owing to the extensive use of PVC in the household, commercial, and industrial sectors.

Major Challenges for Polyvinyl Chloride Market

- The production cost of polyvinyl chloride is highly influenced by the prices of its raw materials such as chlorine, ethylene, and acetylene. Volatility in the prices of raw materials, especially in Asia Pacific, is restraining the PVC market.

Lucrative Opportunities for Global Polyvinyl Chloride Market

- Chlorine and ethylene are combined to form vinyl chloride monomer (VCM). PVC is manufactured from the polymerization of vinyl chloride. PVC is the largest source of the emission of dioxin, a highly carcinogenic chemical produced during the manufacture and disposal of polyvinyl chloride. Some non-chlorinated vinyls such as EVA, PEVA, PVA, and PVB are being used as direct substitutes for PVC. The shift toward eco-friendly PVC is likely to create lucrative opportunities for the polyvinyl chloride market.

More Trending Reports by Transparency Market Research – https://www.prnewswire.com/news-releases/wall-putty-market-to-reach-a-valuation-of-us-6-5-bn-by-2027-emergence-of-new-players-to-toughen-the-competition-in-the-global-market-transparency-market-research-301012427.html

Asia Pacific to Dominate Polyvinyl Chloride Market

- Asia Pacific was the leading region of the global polyvinyl chloride market in 2018. The region is estimated to maintain its dominance during the forecast period. The PVC market in Asia Pacific is anticipated to expand at a rapid pace during the forecast period. More than half of the global production of polyvinyl chloride occurs in China. Rise in construction undertakings in BRIC (Brazil, Russia, India, and China) countries due to increase in population, rise in disposable income, and growth in urbanization is likely to drive the polyvinyl chloride market.

- In terms of consumption, Asia Pacific was followed by North America and Europe in 2018. Europe accounted for a moderate share of the global polyvinyl chloride market in 2018. The demand for packaging in Europe is influenced by economic growth and the level of real personal disposable income. This, in turn, boosts the polyvinyl chloride market in the region.

Rigid Type to Account for Prominent Share

- In terms of type, the rigid segment held a major share of the PVC market in 2018. It is estimated to maintain its dominance during the forecast period. Rigid PVC is a strong, stiff, low-cost polyvinyl chloride that is easy to fabricate and bond using adhesives or solvents. Rigid PVC is a common type of polyvinyl chloride used in the manufacture of pipes, fittings, valves, machining shapes, sheets, and ducts.

- The rigid segment is projected to expand at a rapid pace during the forecast period. Rigid polyvinyl chloride offers advantages for piping due to its low cost and high strength-to-weight ratio.

Construction End-use Industry to Account for Substantial Share

- In terms of value and volume, construction is the leading end-use industry of the PVC market. This trend is projected to continue during the forecast period too. The construction industry segment is likely to expand at a steady pace. PVC is utilized in diverse end-use industries, owing to its suitable physical, chemical, and mechanical properties. PVC is a highly common material employed in the construction sector, owing to its low production cost, ease of processing, and lightweight.

Request for covid19 Impact Analysis – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=60114

Pipes & Fittings Application to Account for Key Share

- The pipes & fittings segment constituted a key share of the global polyvinyl chloride market in 2018. It is likely to maintain its dominance during the forecast period too. The pipes & fittings segment is expected to expand at a rapid pace during the forecast period. The demand for PVC pipes and fittings is significantly high due to their durability and endurance in rough conditions.

- In terms of consumption, the profiles segment held a moderate share of the polyvinyl chloride market in 2018. It is anticipated to expand at a significant pace during the forecast period. PVC is a widely produced plastic, and is extensively employed in profiles, as it is cheap, durable, and easy to assemble.

Leading Players Actively Engage in Joint Ventures and R&D Activities

- Key players operating in the global polyvinyl chloride market include

- Shin-Etsu Chemical Co., Ltd.

- Formosa Plastics

- Inovyn

- ChemChina

- Mexichem S.A.B. de C.V.

- Westlake Chemical Corporation

- Occidental Petroleum Corporation.

- In July 2018, Shintech Inc., a subsidiary of Shin-Etsu Chemical Co., Ltd. in the U.S., commenced the construction of a new integrated plant to produce PVC from salt. The new plant would be located next to Shintech Inc.’s existing plant in Plaquemine, Louisiana, the U.S. The US$ 1.4 Bn investment in the construction of this new integrated PVC plant is expected to boost the company’s PVC business.

- In June 2017, INOVYN won the PVC Polymer Category Award for the second consecutive year at the Best Polymer Producers Awards for Europe 2017. The award is voted for by European customers based on five key criteria – quality; regulatory compliance; delivery performance; communication; and innovation.

- In February 2018, INOVYN announced its intention to deliver a major expansion project at Rafnes Site, Norway. Through the project, the company is expected to increase its vinyl chloride monomer (VCM) capacity at the site by around 70 KT per year.