Oil and gas companies are turning the large volume and variety of data into intelligence for improved asset productivity. Real-time data analysis is essential for deriving value out of unstructured data generated from sensors present in the oil field. Predictive and prescriptive analytics are the approaches that help oil and gas companies to minimize expenses and earn money by turning this data into valuable assets. The creation and consumption of data continues to grow in the oil and gas industry and with it, the investment in data analytics and data management software and services. Data monetization can be used to leverage insights to identify new revenue opportunities, trigger product, process & service innovation and optimization, improve production, and enhance service quality in the oil and gas industry. Large proven oil reserves in Venezuela, Saudi Arabia, Canada, Iran, Iraq, Kuwait, UAE, Russia, the U.S. and China brings an opportunity to drive growth of the oil and gas data monetization market as there is significant growth opportunity for adoption of indirect data monetization i.e. the software and services for driving insights for development of these fields and direct data monetization i.e. mainly the exploration data products. Seismic surveys and geophysical surveys conducted in these regions to find new exploration sites and their potential, and the anticipated use of software solutions will continue to drive the market over the forecast period.

The data monetization in oil and gas market is segmented based on method, component, oil companies, application, E&P lifecycle, and region. The oil and gas data monetization market has two methods of monetization viz., direct and indirect. By component, the market is segmented as data-as-a-service, professional services, and platform/software. Data-as-a-service segment covers data exchange/transaction for direct monetary benefits. Platform/software and professional services represent indirect data monetization. The oil and gas data monetization market is also segmented based on upstream oil companies into National Oil Companies (NOCs), Independent Oil Companies (IOCs), National Data Repository (NDR), and oil and gas service companies. National Oil Companies (NOCs) segment is majorly driven by indirect data monetization and is anticipated to dominate the global oil and gas data monetization market over the forecast period. NOCs are increasingly spending on software/platforms and services, thus accounting for the maximum share in the data monetization market. Further, by application, the market is segmented into upstream (conventional, unconventional), midstream, and downstream. It is anticipated that the upstream application segment will continue to dominate the market over the forecast period. Upstream application segment is also classified by E&P lifecycle into exploration, development, and production segments. Exploration segment is expected to expand over the forecast period driven mainly by increasing adoption of software and solutions in deep-water exploration and shale gas exploration activities.The increasing demand for data products such as seismic survey data, geophysical data, and magnetic survey data is also driving the exploration segment in the data monetization market.

Request for a sample:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=49416

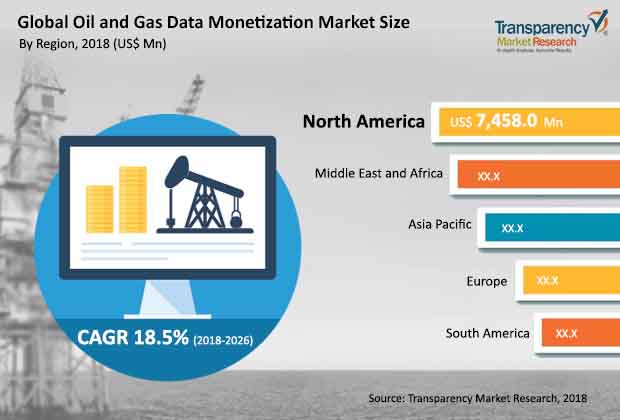

Regional segmentation of the oil and gas data monetization market includes North America, Europe, Asia Pacific, South America, and Middle East & Africa (MEA). North America is projected to dominate the oil and gas data monetization market throughout the forecast period due to availability of necessary infrastructure, increasing oil production, and use of indirect data monetization solutions for shale oil reserves exploration, development & production,and presence of oil and gas service companies involved in direct data monetization. Asia Pacific is expected tobe the fastest growing region during the forecast period due to rising investments in the E&P sector.

Key players in the oil and gas data monetization market are Halliburton, Schlumberger Limited,Informatica Corporation, SAP SE, Oracle Corporation, Accentureplc, IBM Corporation, EMC Corporation, Microsoft Corporation, Tata Consultancy Services Ltd., Datawatch, Drillinginfo, Hitachi VantaraCorporation, Hortonworks, Inc.,Capgemini SE, Newgen Software, Inc., Cloudera, Inc., Cisco Software, Inc.,SAS Institute, Inc.,MapR Technologies, Inc., Palantir Solutions, OSIsoft LLC, Infosys Limited, and NETSCOUT among others. Along with the players mentioned above, the market share analysis of direct data monetization players such as TGS, CGG, PGS, Ion Geophysical Corporation, and Western Geo is also provided separately in the report.

Ask for brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=49416

Focus on Asset Productivity to Expand Horizon in Oil and Gas Data Monetization Market

Oil and gas companies have in recent years have witnessed the transformative potential of advanced data analytics to make decisions across the entire value chain. Two recent developments have become the lynchpin of growing investment potential in the software and services used for monetizing data, directly or indirectly. The demand in oil and gas data monetization market has thrived on the back growing promise of data analytics to boost asset productivity on one hand to combat the declining profits. Over the years, the oil and gas companies have suffered some serious challenges arising out of the fact that hydrocarbon production is declining in popularity. Data analytics are viewed as new framework for decisions that will allow them to reinvigorate their growth strategies. Stalwarts in the oil and gas exploration and production have already leveraged the advantage by collaborating with oil and gas service companies. Asset management, notably predictive and preventive management, is become one of the key objectives for data monetization trends. Various areas including portfolio management and operations management are unlocking the unique value propositions of data analytics. This is a key trend shaping the expansion of the oil and gas data monetization market.

The Covid-19 pandemic has brought several unprecedented challenges to economic growth across the world. Several nations have witnessed the disruptive potential of the still-emerging pandemic on the firms’ production, major business models across key sectors, and strategic frameworks for meeting the end users’ demands. The pandemic has hit the bottom-line of many companies and organizations across almost all industries. The oil and gas data monetization market has also seen some notable upheavals, and have begun looking for frameworks to absorb the macroeconomics and microeconomics shocks. Thus, approaches to harness RoI have changed dramatically in numerous industries, including for upstream and downstream players in the oil and gas sector. Further, the data-driven decisions are expected to become more important than ever, given the uncertainties prevalent in the post-pandemic world.

Read Our Latest Press Release: