Mounting Environmental Concerns and High Adoption from Domestic Sector Likely to Propel Market Growth

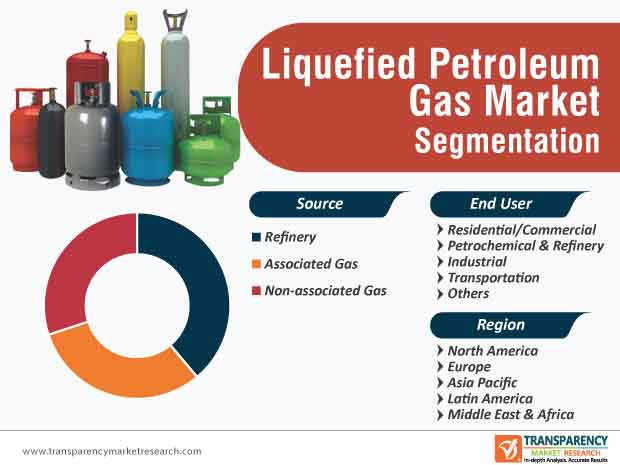

Liquefied petroleum gas has emerged as a clean, efficient, and portage energy source that has garnered considerable popularity around the world. Although liquefied petroleum gas is primarily obtained during oil production and natural gas, in the current scenario, it is increasingly being produced from an array of renewable resources. The exponential rise in the demand for liquefied petroleum gas can be largely attributed to its unique properties due to which, in the current day and age, it can potentially be used in a broad spectrum of industrial spheres for multiple applications. Liquefied petroleum gas is predominantly used across the residential sector, particularly in the Asia Pacific region as a clean-burning smoke-free fuel for indoor cooking.

Due to soaring environmental concerns across the world, governments in various nations are encouraging the use of liquefied petroleum gas by offering subsidies and tax concessions to suppliers and launching favorable policies. The growing awareness pertaining to climate change and global warming has further boosted the demand for liquefied petroleum gas, as it emits negligible quantities of black carbon. The liquefied petroleum gas market is one of the key drivers of economic growth, particularly in rural regions and developing nations due to which, the global liquefied petroleum gas market is expected to grow during the forecast period.

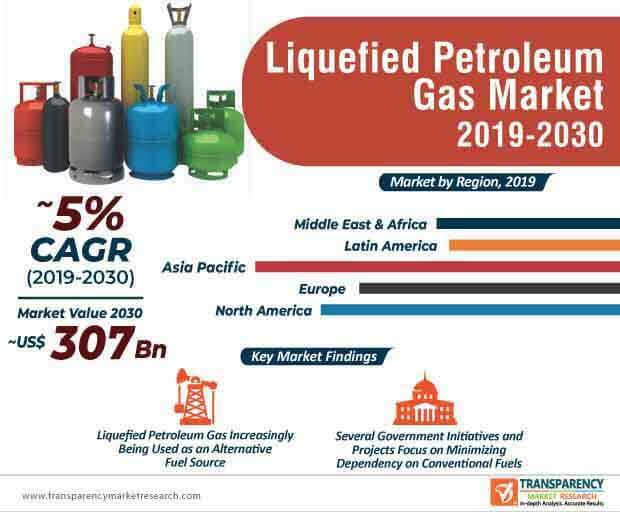

Apart from commercial and residential sectors, transportation, industrial, petrochemical, and refinery sectors are some of the most prominent end users of liquefied petroleum gas. Liquefied petroleum gas also plays a pivotal role in minimizing desertification and deforestation due to which, the demand is likely to remain strong across the world. At the back of these factors, along with a growing emphasis on creating a sustainable energy future in both, the rural as well as the urban areas of the world, the global liquefied petroleum gas market is poised to attain a market value of ~ US$307 bn by the end of 2030.

Request a sample to get extensive insights into the Liquefied Petroleum Gas Market

Adoption of Liquefied Petroleum Gas as Alternative Fuel Source to Provide Lucrative Opportunities

In the current scenario, as awareness levels regarding potential environmental and health safety benefits continue to grow, liquefied petroleum gas is increasingly being used in a range of agricultural, commercial, horticultural, industrial, and manufacturing applications. The global liquefied petroleum gas production has witnessed unprecedented growth in the past decade due to considerable demand from the domestic sector wherein liquefied petroleum gas is used for heating and cooking purposes.

Liquefied petroleum gas is one of the most versatile and flexible fuels and as per current trends, it is one of the most adopted alternative fuel sources worldwide. Liquefied petroleum gas is nearly five times more efficient in comparison with traditional fuel alternatives due to which, the demand is expected to witness further growth.

Liquefied petroleum gas has tremendous potential to minimize carbon emission in transportation systems and improve environmental performance of the industry. Railway systems across the world, particularly in Europe and North America primarily rely on oil that is imported from the Middle East due to which, rising import bills and fluctuating prices of oil have led to a considerable balance of trade. Thus, several countries in the European Union are increasing in favor of diversifying their energy resources to minimize the dependence on oil.

The Commission Transport 2050 Strategy in the European Union aims to decrease Europe’s dependency on oil and reduce the greenhouse emission of the region by nearly 60% by 20250. Other objectives in the proposed initiative include city logistics free of CO2 in urban centers by 2030 and efforts to curb the number of vehicles operating on conventional fuels by half. Projects and strategies similar to these are likely to boost the demand for liquefied petroleum gas during the assessment period. This is expected to fuel the growth of the liquefied petroleum gas market.

To understand how our report can bring difference to your business strategy, Ask for a brochure

Fuel Consumption Declines amid COVID-19 Pandemic

As the COVID-19 pandemic continues to thwart the growth of industrial sector around the world, the consumption of liquefied petroleum gas has witnessed a staggering decline in the first half of 2020. Several countries are under stringent lockdowns due to which, the demand for liquefied petroleum gas as a motor fuel has experienced a consistent decline. Several market participants are currently expected to seek opportunities beyond the traditional markets and cater to the demand for liquefied petroleum gas in these regions. For instance, as the demand for liquefied petroleum gas continued to decline in Europe due to the COVID-19 outbreak, Sibur, Russia’s largest petrochemical company capitalized on the opportunity to enter new markets by supplying liquefied petroleum gas to India.

While the demand from nations in the European Union is likely to remain sluggish, the demand for liquefied petroleum gas from residential and domestic sectors across nations in the Asia Pacific region, is likely to grow despite the COVID-19 event. In addition, as liquefied petroleum gas is considered as an essential commodity, trade is expected to remain smooth. Although the liquefied petroleum gas market is way off its projected growth in 2024, the market is likely to show signs of recovery from the past quarter of 2024. The automotive sector is expected to provide abundant opportunities to the stakeholders involved in the liquefied petroleum gas market in the COVID-19-free era.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Liquefied Petroleum Gas Market

Analysts’ Viewpoint

The global liquefied petroleum gas market is expected to witness healthy growth during the assessment period despite the onset of the novel COVID-19 pandemic. The market growth will be largely driven by mounting environmental concerns, high demand for energy-efficient alternative fuels, favorable functional characteristics of liquefied petroleum gas, and soaring adoption from household and domestic sectors in the Asia Pacific region. Automotive or transportation sector will provide lucrative opportunities in the upcoming years, as governments across the world continue to encourage the adoption of clean and natural fuel resources. These factors are likely to drive the liquefied petroleum gas market during the forecast period.

Liquefied Petroleum Gas Market: Overview

- Liquefied petroleum gas is a flammable mixture of hydrocarbon gases used as a fuel in various end-use industries. It is produced from fossil fuels, during the refining of petroleum crude oil and natural gas.

- Liquefied petroleum gas (LPG), when used as a fuel, burns relatively clean and emits a very few sulfur emissions. LPG is stored and supplied in pressurized steel vessels, as it evaporates at normal temperature and pressure.

- Liquefied petroleum gas is widely used in various applications such as hospitals, agriculture, construction, and automotive. It is largely used as a fuel for cooking in residential and commercial establishments, as it is cost effective and efficient.

Rise in Unconventional Oil and Gas Production to Drive Liquefied Petroleum Gas Market

- Natural gas is produced due to burying of dead plants and animals. Intense heat and pressure caused by burying of dead plants and animals triggers a reaction, which leads to formation of natural gas.

- Special or advanced production techniques are employed to extract natural gas. This gas is termed as unconventional gas. Unconventional gases include shale gas, tight gas, gas hydrates, and coal bed methane.

- According to the World Energy Council, the U.S. has a total of 1,161 trillion cubic feet of technically recoverable unconventional gas. China has 1,115 trillion cubic feet of unconventional gas. The U.S. was the leading country in terms of production of unconventional gas in 2019.

- Advanced technologies are required to extract unconventional fuels. Companies are investing significantly in research and development activities to come up with economical methods to extract unconventional fuels. Thus, production of unconventional fuels is expected to rise in the near future.

- Availability of liquefied petroleum gas has increased over the past few years, due to increase in the production of unconventional gas. Rise in the production of unconventional oil and gas is expected to drive the global liquefied petroleum gas market in the near future.

More Trending Reports by Transparency Market Research – https://www.prnewswire.com/news-releases/increasing-demand-for-power-to-drive-global-underground-mining-market-to-valuation-of-us-25-bn-by-2027–transparency-market-research-301008293.html

Volatility in Prices of Crude Oil to Hamper Liquefied Petroleum Gas Market

- Crude oil prices dropped sharply after 2014. Oil prices are dependent on several factors, including geopolitical and weather-related developments. This can lead to disruption in oil and gas supply chain, thereby resulting in high volatility in crude oil prices.

- Production cost of crude oil is also one of the key factors that govern prices of crude oil. Production cost of crude oil is lower in countries in the Middle East, such as Saudi Arabia and Iran, compared to that in Canada and the U.S.

- Concerns are also ongoing that oil storage capacity is low across the globe. This further hampers investments in the global oil & gas industry. A majority of storage hubs are filled with oil. For instance, more than 77% of the storage capacity in storage facilities of Cushing, Oklahoma city, the U.S. is already in use.

- The price of liquefied petroleum gas is depended on crude oil prices. Changes in crude oil prices affect the demand for liquefied petroleum gas. Thus, volatility in prices of crude oil is anticipated to hamper the global liquefied petroleum gas market during the forecast period.

Rise in Investments in Oil & Gas Industry Globally to Provide Opportunities to Liquefied Petroleum Gas Market

- The global energy sector witnessed surge in oil and gas project approvals in 2019. The demand for liquid fuels is likely to increase in the near future, owing to rise in demand from developing economies across the globe.

- About 140 oil and gas discoveries were made in the year 2018. The total estimate for discovered resources stood at around 9 billion barrels of oil equivalent in 2018. It stood at 10 billion barrels of oil equivalent in 2017. Offshore discoveries were prominent with 60% share, while gas resources accounted for about 40% share.

- In terms of discovery, Latin America was the leading region with 24% of global volumes discovered, which were 2.1 billion barrels of oil equivalent. North America and Europe each accounted for 15% share of the global volumes discovered i.e. 1.3 billion barrels of oil equivalent. Asia Pacific accounted for 11% share, while Middle East & Africa constituted 9% share of the global volumes discovered in 2018.

- Rise in investments in the oil & gas industry is estimated to result in high production of liquefied petroleum gas in the next few years. Demand for liquefied petroleum gas is also expected to increase in the near future, owing to economic prosperity of consumers. Thus, increase in investments in the oil & gas industry presents lucrative opportunities to the global liquefied petroleum gas market.

Recent Developments, Expansions, Acquisitions, and New Contracts in Liquefied Petroleum Gas Market

- On May 13, 2024, Royal Dutch Shell plc invested in a new LNG processing unit in Nigeria. Once operational, the new unit would add approximately 8 million tons per annum of capacity to the Bonny Island facility, whose current capacity is around 30 million tons per annum. This is a joint venture of NLNG, which is owned by the Nigerian National Petroleum Corporation (NNPC – 49%), Royal Dutch Shell plc (25.6%), Total (15%), and ENI (10.4%).

Request for covid19 Impact Analysis – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=491

Asia Pacific to be Highly Lucrative Region of Liquefied Petroleum Gas Market

- Asia Pacific is anticipated to be a highly lucrative region of the global liquefied petroleum gas market during the forecast period. The market in Asia Pacific is estimated to expand at a significant pace between 2024 and 2030, as the oil & gas industry in the region is booming due to rising population. Especially in countries such as China, India, and Japan, the demand for oil and gas is rising. Demand for liquefied petroleum gas in these countries is anticipated to increase in the next few years also.

- Moreover, growth in urbanization and modernization in the region is estimated to boost the demand for liquefied petroleum gas in Asia Pacific during the forecast period

Moderately Fragmented Liquefied Petroleum Gas Market

- The global liquefied petroleum gas market is moderately fragmented. Several international and local players hold a major share of the global liquefied petroleum gas market.

- Major players operating in the global liquefied petroleum gas market are

- British Petroleum plc

- Exxon Mobil Corporation

- Royal Dutch Shell plc

- UGI Corporation

- Kleenheat Gas Pty Limited

- China Gas Holdings Limited

- Copagaz Distribuidora De Gas Ltda

- Repsol S.A

- Origin Energy

- SHV Energy N.V.