GCC Processed Meat Market: Snapshot

The processed meat market in the GCC is primarily driven by the busy lifestyles of consumer in the region over the years. This has caused people to opt for ready-to-consume food items or those that can be served in a short span of time.

Aggressive marketing strategies by manufacturers and increased investments in advertising are also responsible for the growing demand for processed meat in the GCC. Other factors driving the processed meat market are the growing popularity of processed meat-based fast foods among the younger generation, a rise in the number of working women across different countries in the GCC region, and product innovation by leading processed meat manufacturers.

Request Brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=14666

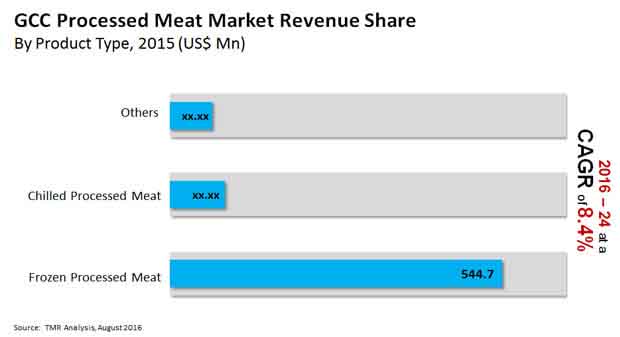

The GCC processed meat market was valued at US$760.7 mn in 2015 and is estimated to reach US$1.5 bn by 2024, expanding at an 8.4% CAGR therein.

More Trending Reports by TMR:

Sales of Frozen Processed Meat Continue to Rise owing to Convenience

In terms of product type, frozen processed meat held the leading share in the GCC processed meat market in 2015, both in terms of revenue as well as volume. Sales of processed meat are expected to be driven by frozen variants across all the countries in the GCC and the market for the same will continue to grow during the forecast period due to the increasing demand for convenient and packaged food products among consumers across all age groups. Chilled processed meat, on the other hand, does not enjoy the same variety and these products have a shorter life. Frozen processed meat products such as hot dogs and salamis are very popular among the younger generation across the GCC.

The others segment, which comprises shelf-stable meat, is projected to expand at a rapid pace during the forecast period in terms of revenue as well as volume. Shelf-stable meat has the lowest unit price; it is consumed for its convenience since it requires no preparation; and it offers numerous marketing options for retail and convenience stores. These advantages are mainly responsible for the growth of this segment.

Buy Now:

https://www.transparencymarketresearch.com/checkout.php?rep_id=14666<ype=S

Poultry Emerges as Leading Meat Type thanks to Health Benefits and Lower Prices

In terms of meat type, poultry accounts for the leading share across the GCC processed meat market. It is also projected to be the most attractive segment during the course of the forecast period owing to rising health awareness among consumers. Across the GCC, consumers are shifting from the consumption of red meat to white meat owing to the lower cholesterol content in the latter. Furthermore, poultry meat is inexpensive compared to beef and lamb and does not contain trans fats that result in coronary heart diseases. This is expected to increase the demand for poultry meat during the forecast period.

In terms of packaging, the processed meat market in the GCC has been segregated into retail packaging and bulk packaging. Retail packaging is the most widely used method for processed meat due to its low price and its ability to enhance the shelf life of processed meat products. Rising retail sales are also propelling the retail packaging segment.

By country, the process meat market has been segmented into Qatar and Rest of GCC. Qatar is expected to witness significant growth from 2016 to 2024, expanding at a value-based CAGR of 8.8%. The UAE is also a major market for process meat, as identified by TMR.

Key players in the GCC processed meat market include National Food Co. (Americana Meat), Al Islami Foods, Sunbulah Group, BRF S.A., Tyson Foods, Cargill Inc., Gulf Food Industries, and Almunajem.