Reinsurance Market – Snapshot

Reinsurance is an arrangement under which the reinsurer company (reinsurer) agrees to protect the insurance company (also known as ceding company) from calamities written under the agreement. Reinsurance is designed to enhance the ceding company’s surplus position and financial strength, and reduce the net amount at risk on specific risks. Reinsurance allows the ceding company to maximize the risk it can underwrite on a single risk and expand the volume of business it can underwrite. The reinsurance includes group and individual critical illness, disability and life & health, and property & casualty (P&C) reinsurance.

In terms of end-user, the non-life/property & casualty reinsurance segment accounted for highest market share in 2017 and is estimated to hold the position over the forecast period. To protect their investments, oil and gas, mining, agriculture, and transportation are some of the leading sectors opting for property & casualty reinsurance services.The global reinsurance market is currently driven by a favorable regulatory environment.

Purchase our Premium Research Report At:https://www.transparencymarketresearch.com/checkout.php?rep_id=55410<ype=S

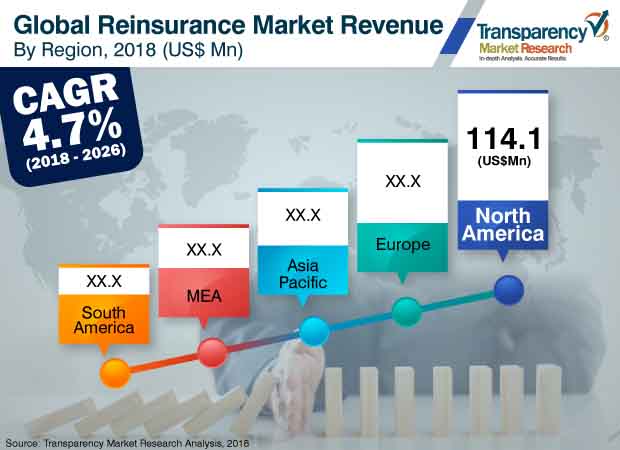

The global reinsurance marketwas valued at US$ 241.14 Bn in 2017 and is expected to expand at a CAGR of 4.7% during the forecast period.

Growth in property catastrophe protection is a major factor expected to drive the reinsurance market. However, lack of disposable income is a major factor restraining the market. Developing countries of Africa have frail economies with resultant low insurance infiltration due to lack of disposable income, and globalization & competition from foreign companies. In South Africa, disposable income per capita is much lower than the OECD average of USD 30,563. Regional economic activities are anticipated to present significant opportunities for the reinsurance market. The United States, China, Germany, Japan, and United Kingdom are some of the countries with the strongest economic growth. Thus, increasing economic activities and public-private collaboration schemes and a movement toward financial stability is offering enormous growth opportunities to the reinsurance market. Local insurers progressively retain premiums. Increased retention is a reflection of insurers’ confidence in their own underwriting. Insurers are starting to retain more risk as it implies that they are concentrating more on the fundamentals, on underwriting, and on their risk selection. However, unrealized investment losses and adverse currency fluctuation have impacted reinsurance capital across all the regions which are however offset by stable operating earnings aided by continued light catastrophe activity.

The global reinsurance market is expected to be further driven by significant growth in Asia Pacific. The region is estimated to constitute a significant market share during the forecast period, with India, Japan, and China contributing most to the region’s revenue. The reinsurance market in Asia Pacific is mainly driven by growth in property catastrophe protection. This is largely because the region has encountered several property losses in the past few years. Moreover, a series of typhoons, floods, earthquakes, and other weather-related losses also impacted the region. For instance, in August 2018, Kerala, a state in India was affected by severe flooding caused by heavy rainfall. The flooding resulted in various property losses and at least a million people were expatriated from their homes. These factors are anticipated to further fuel the demand for reinsurance services around the globe. In the Asia Pacific region, increasing amounts of catastrophe protection are being purchased to secure income instead of essentially ensure capital. As multinational companies have extended their footprintin Asia, they have discovered that country-specific regulatory realities and local practices have occasionally prompted reinsurance decisions that were in conflict with the objectives of the broader multinational group. As a result, reinsurers are advancing to a progressively incorporated or Asia-regionalized reinsurance strategy.

Get More Press Releases by TMR: https://www.prnewswire.com/news-releases/wide-application-range-coupled-with-latest-technological-advancements-to-invite-extensive-growth-for-the-immersive-technologies-market-tmr-301314719.html

Reinsurance Market to See Consistent Growth from Demand for Property Catastrophe Protection

Reinsurance is a common practice adopted by insurance companies to mitigate their risks by partly transferring their risk portfolios to other parties called reinsurers, while the main entity is known as primary insurance companies. Reinsurance market has witnessed some notable disruptions particularly after the outbreaks of COVID-19 pandemic in 2024. The reinsurers are keen on offering value-added services to primary insurers and have taken numerous measures in smoothening the latter’s earnings. The focus has slightly veered off from just covering property catastrophe risks to covering broader array of risks. To this end, they are leaning on developing new business models. The trend of automated risk placement is a key trend expected to become more cogent in the times to come, opine insurance experts. Market modernization initiatives have begun making waves, and will be crucial in the future growth trajectories in the reinsurance market. A rapidly evolving capital markets structuring is a key trend bolstering the expansion of the reinsurance market. The value chain of the market has also been reshaped by the advent of alternative capital, nudging reinsurers to realign their offering to cover a wide range of risks. New technologies used for risk placement and trading are key trends that may affect the course of the reinsurance market.

To gauge the scope of customization in our reports, Ask for a Sample

The COVID-19 pandemic is not mere a humanitarian crisis but a global health pandemic of severe level. The aftermaths have transformed the business and operating models of businesses from across various industries. The reinsurance market has also been battling the economic and social fallout of the pandemic, which is still emerging in some parts of the world due to emerging virus variants. The socio-economic disruptions have strengthened the forces of consolidation among brokers, primary insurers, and reinsurers. This stridently has echoed the relevance of new business models in excavating new revenue streams. The appetite of the buyers have also changed, and there has been rise in renewable rates. Emerging scenarios in the reinsurance market suggest that technology will play a greater role in meeting the clients’ needs in the post-pandemic world.

Contact us:

Transparency Market Research

State Tower,

90 State Street, Suite 700,

Albany NY – 12207,

United States

Tel: +1-518-618-1030 Email: [email protected]

Website: https://www.transparencymarketresearch.com

https://todaysmarkettrends.wordpress.com