Car Finance Companies Lean Toward Digital Lending Tools and Platforms to Streamline Process

The car finance market has experienced considerable developments in the past decade, primarily driven by new business models, rising competition, and the onset of new technologies. The fluctuating sales of automotive vehicles across the world continue to define the course of the global car finance market. The sales of new cars across the world have witnessed a slight decline due to a host of demographic, technical, and economic factors since 2017. In addition, as the inventory of used cars continues to grow, the demand for new cars is decreasing. In addition, amidst the growing environmental concerns and calls to minimize carbon emission, car-pooling, the usage of electric bikes and bicycles has increased across the urban regions of the world. Current trends also indicate that more number of consumers are opting to purchase second-hand cars due to surging prices of new automotive cars due to which, the banking sector around the world is paying more attention to second-hand car financing.

Players operating in the current car finance market are increasingly focusing on simplifying the car finance process and make it customer friendly. In addition, market players are also expected to cater to the growing consumer demand for simpler loan applications and swift credit decisions. Advancements in car finance technologies in the past few years are expected to address these challenges due to which, the car finance market is expected to witness steady growth during the forecast period. The entry of cloud-based lending models and portfolio optimization is driven by data analytics that are expected to play an imperative role in the expansion of the car finance market. At the back of these factors, the global car finance market is expected to attain a market value of ~US$ 3 Trn by the end of 2030.

Request a sample to get extensive insights into the Car Finance Market https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=77372

Focus on Improving Lending Experience and Portfolio Optimization to Propel Market

Advancements in cloud technology are expected to trigger the growth of the global car finance market during the assessment period. As consumer demand for a hassle-free lending experience continues to grow at a rapid pace, stakeholders in the car finance market are projected to leverage cloud technology to cater to these demands. Some of the potential benefits of deploying cloud include swift implementation, cost savings, and efficient delivery of new functions– an important factor that is anticipated to improve the overall lending experience. Cloud-based lending solutions are gradually making inroads in the global car finance market and as per current trends, the market share of on-premise legacy lending systems is projected to decline over the course of the forecast period.

Another significant development within the car finance market is the optimization of the loan portfolio. As data analytics continues to glide through the automotive space, stakeholders operating in the car finance market are increasingly relying on data analytics software to detect the trends and consumer patterns across the lending process of various portfolios. While automotive companies have utilized data for several years for optimum maintenance, data analytics is likely to establish a strong presence in the car finance market during the forecast period. Market participants are increasingly leaning toward using data analytics software to enhance customer experience and streamline the overall data governance structures.

Car Finance Companies Focus on Refinancing and Extensions amid COVID-19 Crisis

The COVID-19 pandemic has put the brakes on the growth of several industries worldwide and the car finance market is treading through a similar path. Players operating in the current car finance market landscape are estimated to address various challenges, including dwindling consumer confidence and declining sales of new cars in the upcoming years to establish a strong foothold in the market. Due to the unpredicted turn of events, car sales around the world are likely to witness a major slump in 2020 and potentially, the first half of 2021. In their bid to establish a substantial market share, market players are expected to focus on servicing activities, such as refinancing and extensions by leveraging digital tools to accelerate the process remotely. Several companies are also expected to offer payment relief such as deferred lease payments and extensions to existing borrowers that are affected by the COVID-19 virus. Companies are projected to switch to digital lending solutions to ensure business continuity during the ongoing health crisis.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Car Finance Market https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=77372

Car Finance Market: Overview

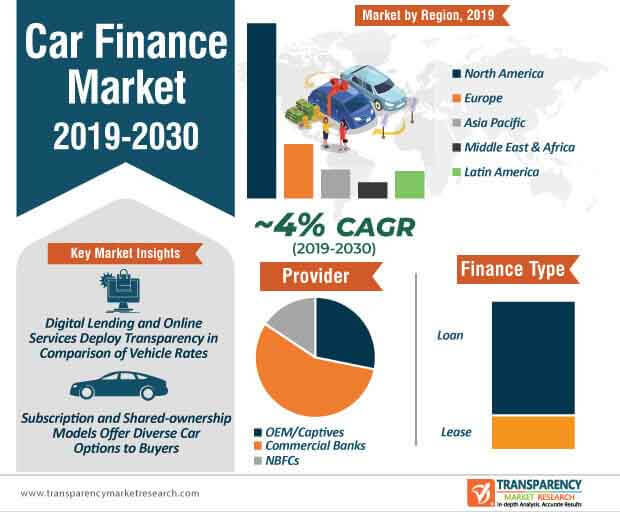

- The global car finance market is anticipated to expand at a CAGR of ~4% during the forecast period, owing to increase in car sales and rise in penetration of car finance in developing countries

- Car finance is a mature market in developed nations and it is expanding rapidly in developing countries such as China, India, Brazil, and Mexico. Car finance has become an effective means to avail car ownership/usage without paying outright capital, which in turn is helping boost mobility demand among low-income communities.

Car Finance Market: Key Drivers

- The millennial generation has entered the workforce and is gaining economic stability and purchasing power. Millennials are first-time buyers and exhibit higher preference for auto loans and lease as compared to that for direct cash purchase. Rise in the number of car consumers among millennials and generation Z is projected to boost the car finance market.

- Developing countries such as China, India, Mexico, and Brazil are recording high sales of new cars, and rising penetration of financed new cars among total cars sold are anticipated to drive the global car finance market

- Increase in awareness among consumers regarding car finance options in developing countries and lucrative offers such as low interest rate EMIs and zero down payment are anticipated to drive the car finance market. Diversification of automakers into financial services and aggressive marketing through dealership have been pivotal in driving the global car finance market.