Cryptocurrency Trading Software Platform Market – Introduction

- A cryptocurrency trading software platform allows users to perform crypto exchanges, manage NFT marketplaces, and digital banking transaction for cryptocurrency. A cryptocurrency trading software platform helps to build digital platforms for crypto traders and investors based on trading technologies and tools.

- Crypto traders are facing difficulties while investing in digital currency due to different rules and regulations by exchanges in the verification process. Companies are offering a solution with an easy user interface and dashboard solution to manage different exchange accounts in one trading platform. Solution providers are also offering new features such as margin trading and margin lending to enhance the performance of the cryptocurrency trading software and user experience.

- Solution providers deploy software versions in mobile apps, desktop apps, and web-based access platforms with customizable trading interfaces to increase the adoption of digital platforms by end-users.

- Cryptocurrency trading software platforms are supporting cryptocurrencies such as Bitcoin, Ethereum, Polkadot, Litecoin, Bitcoin Cash, Dogecoin, and other cryptocurrencies as per user demand.

Planning to lay down future strategy? Perfect your plan with our report sample here https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=82451

Key Drivers of the Cryptocurrency Trading Software Platform Market

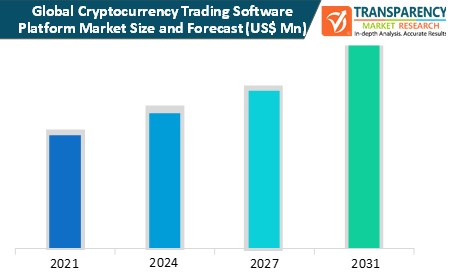

- Increasing investment in cryptocurrency by investors and growing demand for advanced cryptocurrency trading management platforms are expected to drive the growth of the market. Companies are investing in platforms or tools which manage different exchange accounts. This is also expected to boost the growth of the cryptocurrency trading software platform market.

- Increasing adoption of mobile-based trading applications is expected to create better business opportunities for solution providers of cryptocurrency trading software platforms.

Uncertain regulatory status on cryptocurrency expected to hinder market growth

- Cryptocurrency is an emerging financial technology, but the lack of regulations and a common standard for digital currency is expected to restrain the growth of the market.

- Lack of knowledge about cryptocurrency investment and trading systems in developing countries is also expected to hamper the growth of the market.

Impact of COVID-19 on the Global Cryptocurrency Trading Software Platform Market

- Most people are investing in cryptocurrencies to increase the return on investment during the COVID-19 pandemic situation. The number of investors and traders surprisingly increased during the pandemic to invest in secure and more reliable digital currencies. Demand for managing different exchange accounts in one platform also creates new business opportunities for solution providers.

- Demand for cryptocurrency trading software platform solutions is increasing during the COVID-19 lockdown situation and is also likely to show better growth during the forecast period due to the increasing awareness and investment in cryptocurrency by end-users.

North America to Hold Major Share of the Global Cryptocurrency Trading Software Platform Market

- North America holds a prominent share of the cryptocurrency trading software platform market due to the increasing demand for advanced trading platforms or tools among large professional investors and individual investors.

- The cryptocurrency trading software platform market in Asia Pacific is expected to expand the fastest during the forecast period due to increasing investment by major players to provide the solution across the region and also due to the increasing number of investors and traders in major countries such as India, China, and Japan.

Looking for exclusive market insights from business experts? Buy Now Report here https://www.transparencymarketresearch.com/checkout.php?rep_id=82451<ype=S

Key Players Operating in the Global Cryptocurrency Trading Software Platform Market

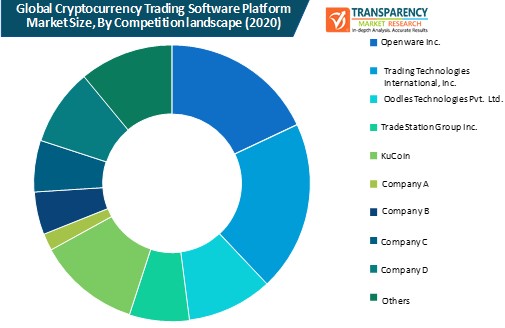

- Openware Inc.

Openware Inc. was founded in 2006 and is based in Paris, France. The company offers an advanced digital platform solution for cryptocurrency management. The company offers solutions such as digital assets exchange, decentralized exchange, digital banking, NFT crypto marketplace, brokerage platform, market-making & liquidity, and custody & wallets.

- Trading Technologies International, Inc.

Trading Technologies International, Inc. is a global provider of high-performance trading software platforms and solutions. The company offers solutions and services to brokers, proprietary traders, international banks, hedge funds, and other trading institutes.

Other key players operating in the global cryptocurrency trading software platform market include Oodles Technologies Pvt. Ltd., TradeStation Group Inc., KuCoin, Altrady BV, Devexperts LLC., B2BX Digital Exchange, and skalex GmbH.

Global Cryptocurrency Trading Software Platform Market: Research Scope

Global Cryptocurrency Trading Software Platform Market, by Deployment

- Desktop Apps

- Mobile-based Apps

- Web-based Apps

Global Cryptocurrency Trading Software Platform Market, by End-user

- Commercial/Professional Traders

- Individual/Personal Users

Global Cryptocurrency Trading Software Platform Market Segmentation, by Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Russia

- Italy

- Spain

- Nordic

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- Malaysia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- South America

- Brazil

- Rest of South America

Alternative Keywords

- Multi-Exchange Cryptocurrency Trading Platform

- Crypto Exchange Software

This study by TMR is all-encompassing framework of the dynamics of the market. It mainly comprises critical assessment of consumers’ or customers’ journeys, current and emerging avenues, and strategic framework to enable CXOs take effective decisions.

Our key underpinning is the 4-Quadrant Framework EIRS that offers detailed visualization of four elements:

- Customer Experience Maps

- Insights and Tools based on data-driven research

- Actionable Results to meet all the business priorities

- Strategic Frameworks to boost the growth journey

The study strives to evaluate the current and future growth prospects, untapped avenues, factors shaping their revenue potential, and demand and consumption patterns in the global market by breaking it into region-wise assessment.

The following regional segments are covered comprehensively:

- North America

- Asia Pacific

- Europe

- Latin America

- The Middle East and Africa

The EIRS quadrant framework in the report sums up our wide spectrum of data-driven research and advisory for CXOs to help them make better decisions for their businesses and stay as leaders.