Bangladesh Corn Oil Market: Snapshot

Corn oil is used in edible as well as non-edible applications. Globally, Bangladesh is one of the major consumers as well as importers of edible oil. With the growing demand for edible oil in the domestic market, there is a surge in investment opportunities as far as the production of edible corn oil is concerned. The rising focus of the authorities on decreasing the country’s dependence on imports by increasing local production will prove to be immensely beneficial for the corn oil market in Bangladesh.

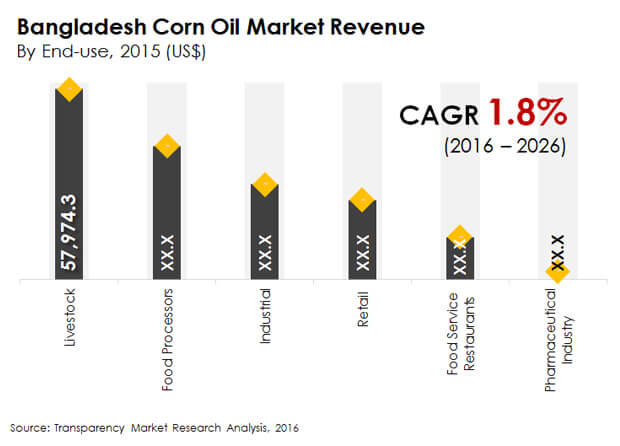

In terms of value, the Bangladesh corn oil market is expected to expand at a CAGR of 1.8% during the forecast period. The market was valued at US$167,073 in 2015 and is expected to reach US$202,072 by 2026.

Non-edible Corn Oil Enjoys Preference over Edible Variants

On the basis of type, the corn oil market is bifurcated into edible and non-edible. In terms of revenue, non-edible corn oil is expected to account for the leading share throughout the course of the forecast period. The segment is estimated to account for a 71.4% share in the Bangladesh corn oil market by the end of 2016. This is attributed to the increasing usage of corn oil for the production of biodiesel. The segment is expected to expand at a CAGR of 1.7% during the forecast period.

Request Brochure @

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=16097

The edible oil segment is expected to show substantial growth in the near future. The segment is expected to expand at a CAGR of 2.1% during the forecast period, driven primarily by the changing dietary habits and improving living standards of the consumers. Moreover, growing consumer awareness regarding the high nutritive value of corn oil is expected to boost the growth of this segment over the duration of the forecast period.

Food Service Restaurants Restricting Usage of Corn Oil owing to Higher Prices

By end use, livestock accounted for the leading share of 34.7% in 2015 and is expected to expand at a modest CAGR of 2.0% during the forecast period. The segment is expected to retain its dominance through 2026. The revenue generated by the industrial segment is expected to report a 2.5% CAGR between 2015 and 2026 – the highest growth rate among other end-use segments. This is attributed to the growing application of corn oil in the manufacturing of biodiesel. The demand for corn oil in the industrial sector is also owing to the increased usage of corn oil in various applications such as rustproofing metal surfaces and in inks, textiles, and paints.

REQUEST FOR COVID19 IMPACT ANALYSIS –

https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=16097

The segment of food service restaurants is expected to exhibit a comparatively slower growth rate over the forecast period and also accounts for a small share in the overall corn oil market. Prices of edible corn oil are comparatively higher than other edible oils in the country, which is projected to restrict the growth of this segment over the forecast period.

The retail segment, on the other hand, is expected to reflect sustainable growth in the near future. Growing consumer preference for healthy cooking and edible oils in order to lower the risk of heart diseases is expected to support this segment. Promotional campaigns by existing oil manufacturers have had a significant impact on consumers in the country and has created a sense of awareness among them regarding the consumption and benefits of heart-healthy products. Corn oil offers a number of advantages in this regard – lower cholesterol levels and controlled blood pressure levels.

Key players in the Bangladesh corn oil market include Adani Wilmar Ltd, Associated British Foods plc, American Vegetable Oils, Inc., and Olympic Oils Ltd.