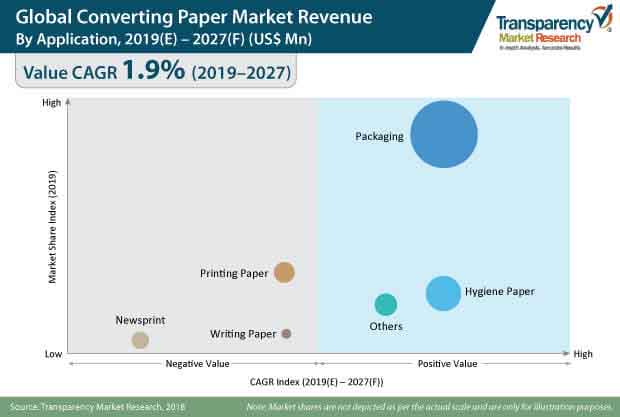

According to Transparency Market Research’s recent report titled “Converting Paper Market Global Industry Analysis, Size, Share, Growth, Trends, Historic Analysis 2014–2018 and Forecast 2019–2027,” the growth of the paper packaging industry is attributed to boost the demand for converting paper during the forecast period. The global market for converting paper was valued at US$ 375.9 Bn in 2018 and is projected to expand at a poor CAGR of 1.9%, during the forecast period (2019-2027).

The global converting paper market is segmented on the basis of application, end-use, pulp type, and paper type. In terms of application, the converting paper market is segmented into printing paper, newsprint, writing paper, hygiene paper, packaging, and others. In the packaging segment, converting paper is used for manufacturing carton board, corrugated board, and flexible paper.

More than half of the converting paper is used in the packaging applications owing to low cost and eco-friendly packaging formats. In the global converting paper market, newsprints, printing papers, and writing papers application segments are expected to reduce in market size during the forecast period. The carton board segment is projected to witness fast-paced growth throughout the forecast period.

Request for a sample:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=21242

Converting Paper Is Repositioning the Paper Industry as “Fiber Industry”

The consumption of converting paper for tasks apart from writing and printing is increasing across the globe. For example, sanitary and packaging markets are becoming the emerging end users for the converting paper market. The adoption of converting paper for industrial packaging is increasing owing to low cost and sustainability as compared to plastic, metal, and glass. The use of converting paper material for manufacturing of intermediate bulk containers, liners, sacks, and absorbents has considerably increased in the past few years owing to the high-quality products offered by packaging leaders such as Sealed Air, Mondi, DS Smith, and others.

Expansion of E-Commerce Packaging Sector Fueling Demand for Converting Paper

The evolving e-commerce industry is embracing converting paper for shipment packaging owing to the quality expectations of customers and the need for lightweight packaging formats. Penetration of E-Commerce in the retail market is growing at a substantial rate. With this growth, the demand for efficient packaging solutions is also increasing. Packaging is one of the key factors influencing consumer preference. Companies want to stay a step ahead of their competitors to ensure maximum market share, which is why, they are willing to invest in superior packaging solutions. Also, using sturdy corrugated boxes for transit ensures safe delivery of the product.

Digitalization Compelling Converting Paper Manufacturers to Incorporate Innovative Features

The growing adoption of digitalization is expected to reduce the demand for printing and writing paper. Digital media and paperless communication are replacing paper, and threatening the traditional market for newsprint and office paper. The market share of printing and writing paper is shifting to packaging paper owing to the growth of the e-commerce market and consumer preference for converting paper packaging formats. Digitalization is negatively affecting printing and writing paper markets, but it still has benefits for converting paper manufacturers and suppliers. With the help of digital tools, converting paper and packaging companies are improving their customer services and manufacturing activities to ensure improved product quality, tracking information of shipped goods, and convenient customer support.

Global Converting Paper Market: Recent Developments

- In October 2018, GP (Georgia Pacific) Pro introduced Dixie Ultra® Insulair Paper Hot Cup, which is equipped with air pockets that insulate the hot beverage from the cup holder’s hands

- In February 2018, Canfor Corporation announced the establishment of a new sawmill in Georgia with an approximate investment of US$ 120 Mn, and production capacity of 275 Mn board feet

- In November 2017, Stora Enso launched a new product called fiber cup, a paperboard-based product, for use in packaging dairy products and other chilled foods

- In September 2017, International Paper Company invested around US$ 300 Mn for converting its paper machine at Riverdale Mill from uncoated freesheet to high-quality whitetop linerboard and containerboard. The investment will add 450,000 tons of annual capacity, with the flexibility to shift between containerboard products

- In July 2017, UPM Paper ENA introduced a magazine paper, UPM Impresse Plus C, a super-calendared paper custom-developed for coldest offset printing, which offers smooth finish, solid images, and a velvety touch.

Ask for brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=21242

Global Converting Paper Market: Competitive Landscape

The global converting paper market critically analysed key players during the course of the study. These include Stora Enso Oyj, Georgia-Pacific LLC, Canfor Corporation, International Paper Company, Clearwater Paper Corporation, UPM-Kymmene Oyj, P.H. Glatfelter Co., Domtar Corporation, Mitsubishi Paper Mills Limited, Verso Corporation, BillerudKorsnäs AB, Burgo Group SPA, Twin Rivers Paper Company Inc., American Eagle Paper Mills, Delta Paper Corp., Catalyst Paper Corporation, Asia Pacific Resources International Holdings Ltd., Rolland Enterprises Inc., Alberta Newsprint Company Ltd., and Finch Paper LLC.

Changing Industry Dynamics in Converting Paper Market Stimulates Adoption of Cutting-Edge Converter Machines

Converter paper, or the converting process for fiber, has attracted scant attention outside the parlance of the packaging sector, despite the ubiquity of the process in all paper products. A variety of commercial and industrial end users in the converter paper has benefitted from the use of converting process to meet their needs. Some of the common applications in the converting paper market are tissue packaging, nonwoven converting, bag converting, digital printing, writing paper, and hygiene paper. In particular, for the past several years, a rapidly expanding array of use of converting paper in industrial and commercial packaging solutions in the pre-Covid era has lent high lucrativeness to the market. A number of printing techniques have come to the fore that that compatible with the customized demand of end-use industries of the packaging sector. Proliferating demand for corrugated board and flexible paper has spurred consumer demands in the converting paper market. A large proportion of converted paper in the packaging sector is used to offer environmentally friendly solutions to end-use industries such as food services industries. The cost-effectiveness and wide option of economic branding options possible with converted paper in contrast with metal and plastic packaging has spurred the prospects in the converting paper market.

In recent years, the Industry 4.0 has spurred the popularity of automated converting machines, opening new avenues in the converting paper market. Further, there has been a demand for converting paper even in the Covid-19 era to meet the bulk of demand from the e-commerce industry. However, the pandemic-led lockdowns has led to slump in manufacturing especially in the Q2 of 2024. Raw material supply chain also suffered, along with the retail product sales. Thus, stakeholders in the converting paper market, especially in developing economies, lent toward adopting business models that could fit well within their budgets. In the coming months, with the recent emergence of Covid-19 vaccines in healthcare systems, policy makers have been able to paint an optimistic picture of economic growth. Such developments will also expand the horizon of the value chain in the converting paper market.

Read Our Latest Press Release: