Sluggish Business Activities amidst COVID-19 Pandemic Affect Sales of Automotive Wheels

The automotive wheel market in Asia Pacific is projected to grow at a fast rate during the forecast period. However, the auto industry in India is growing at a sluggish pace due to the ongoing COVID-19 (coronavirus) pandemic. As such, car manufacturing is slowly picking pace whilst manufacturers are making efforts to inhibit the spread of coronavirus. Facility shutdowns and delayed shipments of raw materials have been common restraining factors for automobile manufacturers. Manufacturing in the Indian auto industry is gaining momentum, as companies are strictly abiding by government guidelines to ensure the safety of their workers and employees. These factors are projected to drive the automotive wheel market during the forecast period.

Get Sample Copy:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=47883

Manufacturers Invest in State-of-the-art SAE- and TUV-approved Facilities

Companies in the automotive wheel market are pushing their boundaries to deploy technological innovations in components. Vossen Wheels-a manufacturer of luxury and performance forged wheels, has gained efficacy in the development of custom finish automotive wheels that are SAE- (Society of Automotive Engineers) and TUV- (Tough Utility Vehicle) approved. Companies in the automotive wheel market are increasing their production capabilities to manufacture high-end, deep-dish wheels that are joining the bandwagon of premier products.

Manufacturers are directing their investments in state-of-the-art TUV-approved facilities in order to gain global recognition in the market landscape. They are investing in brand-new machineries that offer tinted gloss black and other finishes to automotive wheels. The concept of Fine Element Analysis (FEA) is growing popular among automotive wheel manufacturers who aim to gain a competitive edge over other market players.

Grab an exclusive PDF Brochure of this report:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=47883

Development of Lightweight Automotive Wheels In Line with Fuel Emission Regulations

The decline of car weight has been an issue of central focus for automakers. Hence, companies in the automotive wheel market are increasing their research spending to innovate in alloy wheels. For instance, Rio Tinto-an Anglo-Australian multinational metal corporation, joined forces with researchers at the Arvida Research and Development Centre (ARDC), Canada, to introduce Revolution-Al™, a new high strength aluminum alloy developed to make lightweight car wheels. There is a growing need to develop stronger alloys for die cast car wheels that help reduce fuel consumption.

Lightweight car wheels are in high demand to improve the safety and handling of vehicles. With the help of improved automotive wheels, manufacturers are able to meet strict industry standards of governments, pertaining to fuel emission regulations. Car manufacturers in the automotive wheel market are working closely with their customers to gain data about their experience through various trails and tests.

Request For Customization:

https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=47883

Automatic Alloy Wheel Surface Treatment Becomes Mainstream with Industry 4.0 Revolution

Pre-polishing and finishing of automotive alloy wheels play an instrumental role in car manufacturing. Hence, stakeholders in the automotive wheel market are extending their fine polishing services to car manufacturers. For instance, Fintek – a provider of surface finishing and superfinishing solutions, is capitalizing opportunities in the booming Industry 4.0 revolution, which is bringing a significant change in fine polishing for alloy wheels. As such, alloy wheels are estimated to dictate the highest revenue share among all wheel types in the automotive wheel market.

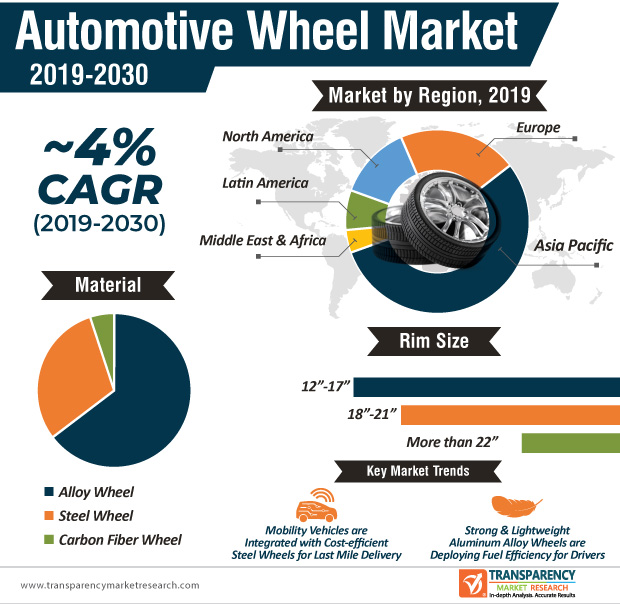

Lucrative opportunities in Industry 4.0 are creating value-grab opportunities for automotive wheel manufacturers. As such, the market is estimated to register a modest CAGR of ~4% during the forecast period. Automatic surface treatment, deburring, and polishing of wheels hold promising potentials for car manufacturers amidst the Industry 4.0 revolution.

Advanced Simulation Techniques Help Develop New Steel Grades

New materials and manufacturing technologies are delivering innovations in steel wheels. Companies in the automotive wheel market are adopting new design tools and materials such as high strength steels to innovate wheels. They are conducting static and dynamic structural analysis to develop high performance steel automotive wheels. Other manufacturing rituals include process stamping simulation and finishing practices to develop high-strength automotive wheels.

Restrictive requirements from OEMs (Original Equipment Manufacturers) and aftermarkets have compelled manufacturers to adopt a broad array of product and process simulations. For instance, Meritor Inc.- a U.S. automobile component manufacturer in Michigan, is applying its improved simulation capabilities to transform ordinary steel wheel development procedures. With the help of new manufacturing techniques, manufacturers in the automotive wheel market are able to introduce new steel grades in the market. Wheel stiffness simulation and torque simulation techniques are increasingly replacing traditional design simulation tools such as cornering fatigue test simulation.

Cost-effective and Validated Steel Wheels Create Incremental Opportunities for Manufacturers

Flow-formed rims are being highly publicized to reduce the weight of automotive wheels. Environment-friendly flow-formed rims are being used to obtain variable thickness in steel wheels. Apart from passenger vehicles, companies in the automotive wheel market are tapping into incremental opportunities in commercial vehicles that ensure last mile delivery. Maxion Wheels – a manufacturer of steel and aluminum wheels, has identified challenging requirements for new mobility applications in commercial vehicles. Manufacturers are strategizing to maximize their business for light- and medium-duty vehicles that serve last mile deliveries.

Moreover, companies in the automotive wheel market are innovating in steel wheels that are repurposed for vehicles that run on electric powertrains. Cutting-edge steel automotive wheels are meeting end user requirements for mobility in urban transport vehicles. Manufacturers are increasing their R&D muscle to develop cost-effective and validated steel wheels for mobility vehicles.

Analysts’ Viewpoint

The auto industry has issued a set of renewed guidelines pertaining to the ongoing COVID-19 scare, which is directed toward its employees and stakeholders. The automotive wheel market in Europe is anticipated to generate the highest revenue. However, steel wheels are giving tough competition to aluminum wheels, since companies are adopting new design tools and materials for manufacturing. Thus, manufacturers should collaborate with the right research talents around the world to deploy fuel efficiency with the help of lightweight aluminum alloy wheels.

Automotive Wheel Market: Overview

- The global automotive wheel market is anticipated to expand at a CAGR of ~4% during the forecast period, owing to rise in sale and production of vehicles across the globe that has led to an increase in consumption. This, in turn, is estimated to boost the production of automotive wheels. A rise in investment in research and development by vehicle manufacturers to enhance fuel efficiency of vehicles is projected to boost the automotive wheel market across the globe.

- Rise in demand for electric vehicles due to enactment of stringent emission norms across the globe is anticipated to propel the automotive wheel market. Electric vehicles are gaining popularity globally. Lightweight is imperative in an electric vehicle to offset the weight of the battery. Therefore, a rise in sales of electric vehicles is expected to boost the sales of alloy wheels.

Drivers of Automotive Wheel Market

- Developing countries, such as India, China, Brazil, and Mexico have planned to enact emission regulations equivalent to Euro 6. The adoption of such reforms by developing countries, which are also witnessing high vehicle production, is anticipated to drive the demand for automotive wheels across the globe.

- SUVs have been early adopters of alloy wheels, as they offer better off-road handling capabilities, improved steering, and lower the unsprung weight of the vehicle. Cast and forged alloy wheels are preferred in SUVs over steel wheels. Sales of SUVs have been rising consistently for the past five years, which indicate a potential market for alloy wheels. Presently, demand for sport utility vehicles (SUVs) around the world is increasing at a significant pace. Increased consumer preference toward SUVs, and a rise in disposable income and reliable financial options coupled with declining interest rate are boosting the sales of the SUVs, which in turn is anticipated to boost the automotive wheel market across the globe.

Challenges for Automotive Wheel Market

- Major vehicle manufacturers shutdown their plants due to the COVID-19 pandemic, which led to a decline in vehicle production and sale. Prominent automakers, including GM, Ford, and FCA, under pressure from unions to protect employees and to follow government advisories, decided to idle their plants across the globe. Toyota, Honda, Tesla, and Nissan also announced a temporary suspension of production across the globe, which is a major challenge for the automotive wheel market across the globe.

- Steel wheels are heavier than alloy wheels and hence, hamper fuel economy. Rising concern over emissions and fuel-efficient vehicles is projected to restrain the demand for steel wheels. Increased demand for electric vehicles is expected to further hamper the demand for steel wheels. The manufacturing cost of an alloy wheel is high due to an elaborate and complex process, which restrains its adoption. Alloy wheels are not as strong as steel and are prone to cracks and dents. Repairing of alloy wheels is difficult and mostly manufacturers recommend discarding and not repairing alloy wheels. This is likely to pose a challenge for the automotive wheel market across the globe.

Segmentation of Automotive Wheel Market

- Based on vehicle type, the passenger vehicle segment dominated the global automotive wheel market due to rise in production of passenger vehicles across the globe. The demand for premium passenger vehicles, which provide comfort, is increasing due to a rise in disposable income of people and an increase in purchasing power of people across the globe.

- Based on material, the alloy wheel segment dominated the market, owing to a rise in the demand for lightweight vehicles to enhance fuel efficiency of the vehicle. Major vehicle manufacturers use alloy wheel to enhance vehicle dynamics, which is likely to boost the automotive wheel market across the globe.

Read TMR Research Methodology @:

https://www.transparencymarketresearch.com/methodology.html

Automotive Wheel Market: Regional Analysis

- Based on region, the global automotive wheel market has been segregated into North America, Asia Pacific, Europe, Latin America, and Middle East & Africa

- Asia Pacific and Europe are projected to be highly lucrative regions during the forecast period. This is primarily due to the presence of prominent automotive industry in China, Germany, Japan, and India. Increasing demand for enhanced fuel economy in vehicles across Asia Pacific is likely to boost the automotive wheel market in Asia Pacific. Major presence of original equipment manufacturers and tier-1 suppliers across Europe, who have advanced research and development facilities in material composition, is anticipated to propel the automotive wheel market in Europe.

Automotive Wheel Market: Competition Landscape

- Key players operating in the global automotive wheel market include

-

- ARCONIC

-

- BBS Alloy Wheel

-

- BORBET GmbH.

-

- CITIC Dicastal Wheel Manufacturing Co.

-

- Enkei

-

- Fuel Off Road Wheels

-

- Foshan Nanhai Zhongnan Aluminum Wheel Co., Ltd

-

- MAXION Wheels

-

- MHT Luxury Wheels.

-

- RONAL Group

-

- TSW Wheels

-

- WHEELPROS LLC

-

- Superior Industries International Inc.

- Key players at the global level are expanding their footprint by engaging in mergers and acquisitions with several players in the industry. In October 2019, MAXION WHEELS partnered with ZF OPENMATICS to help fleets perform more safely and efficiently by collecting essential vehicle data at the wheel through its groundbreaking MaxSmart technology. On October 31, 2018, ARCONIC sold its Texarkana, Texas, U.S. rolling mill to Ta Chen International, Inc., a U.S.-based subsidiary of aluminum and stainless steel distributor. The deal was valued at ~US$ 350 Mn.

Read Our Latest Press Release:

About Us

Transparency Market Research is a next-generation market intelligence provider, offering fact-based solutions to business leaders, consultants, and strategy professionals.

Our reports are single-point solutions for businesses to grow, evolve, and mature. Our real-time data collection methods along with ability to track more than one million high growth niche products are aligned with your aims. The detailed and proprietary statistical models used by our analysts offer insights for making right decision in the shortest span of time. For organizations that require specific but comprehensive information we offer customized solutions through ad-hoc reports. These requests are delivered with the perfect combination of right sense of fact-oriented problem solving methodologies and leveraging existing data repositories.

Contact

Transparency Market Research State Tower,

90 State Street,

Suite 700,

Albany NY – 12207

United States

USA – Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com