ASEAN Folding Cartons Market: Snapshot

The ASEAN folding cartons market has gained significant impetus from the robust growth of small- and medium-sized enterprises (SMEs) and various other industries in ASEAN countries over the last couple of years. Since there is a free trade agreement between the ASEAN countries, most of the small and large scale industries need packaging materials in large volume, consequently boosting the demand for folding cartons.

The preference for folding cartons is anticipated to increase further, thanks to the cost benefits, these cartons provide during transportation and handling of products. The rising demand for packaged and takeaway food products is also projected to influence the market for folding carton in ASEAN countries. However, the availability of flexible plastic packaging materials and rigid boxes at comparatively low prices may limit the uptake of folding cartons to some extent over the forthcoming years, reflecting negatively on this market.

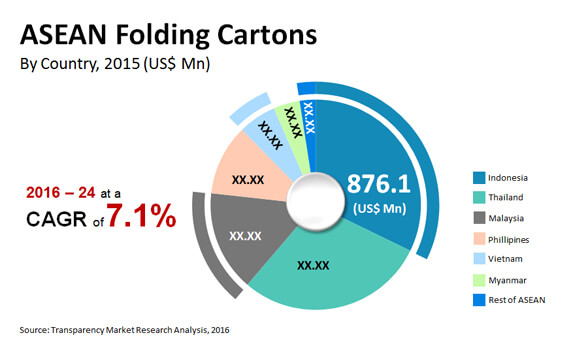

The opportunity in the ASEAN folding cartons market was worth US$2.8 bn in 2016. Rising at a CAGR of 7.10% between 2016 and 2024, the market is estimated to reach a value of US$4.9 bn by the end of 2024.

You will get Custom Report at Syndicated Report price, Buy Now

Food and Beverages Industry to Remain Dominant End User of Folding Cartons

The industrial food and beverages, homecare products, personal care, pharma and healthcare, and tobacco sectors are the key end users of the folding cartons in the ASEAN market. Among these, the food and beverages industry has emerged as the leading end user of folding cartons and is expected to remain dominant over the next few years, rising at a CAGR of 6.80%. In the food and beverage sector, these cartons find a robust usage in the packaging of fresh food products.

Among other end users, the pharma and healthcare and the personal care industries are anticipated to witness a healthy rise in the adoption of folding cartons in the near future. The increasing middle-class population in ASEAN countries and the rising awareness pertaining to the beneficial properties of these cartons are likely to boost their uptake in these industries over the years to come.

Demand for SBS-based Folding Cartons to Continue at Robust Pace

Solid bleached sulfate (SBS), coated unbleached kraft (CUK), uncoated kraft boxboard (UKB), and coated recycled board (CRB) are the three main types of materials, which folded cartons are produced of. Among these, the demand for SBS-based folding cartons is significantly higher as compared to others. Analysts expect this segment to witness continued demand over the forthcoming years. However, in terms of revenue, UKB-based folding cartons are likely to fare better than others in the near future.

Indonesia, among all the ASEAN countries, has surfaced as the key contributor to the ASEAN folding cartons market. Analysts estimate this domestic market to continue its leading streak over the next few years, expanding at a CAGR of 7.20% between 2016 and 2024. In Indonesia, the food and beverage sector has been reporting a strong demand for folding cartons and is likely to continue doing so in the near future. Thailand and Malaysia are also anticipated to provide promising opportunities to market players over the coming years.

Get More Press Releases by TMR: https://www.prnewswire.com/news-releases/long-term-health-hazards-loss-of-natural-habitat-of-terrestrial-aquatic-animals-due-to-rise-in-air-pollution-levels-drives-growth-in-air-quality-monitoring-equipment-market-valuation-projected-to-surpass-us-4-7-bn-by-2031–opi-301284496.html

The ASEAN market for folding cartons is a highly competitive in nature. Some of the key players in this market are Amcor Ltd., AR Packaging Group AB, Huhtamaki Group, Mayr-Melnhof Karton Gesellschaft M.b.h., International Paper, DS Smith Plc, and Rengo Co. Ltd.

ASEAN Folding Cartons Market to Thrive on Rebounding of E-commerce Activities in Post-Covid Era

Growing concerns of the sustainability in the overall packaging sector, paperboard packaging materials have gained popularity in the ASEAN folding cartons market. Folding characteristics and printing options are key concerns. In the months of 2024, in the backdrop of Covid-19 creating macro- and micro-economic upheavals, governments of ASEAN member states have also come out with regional response system, to boost decline in economic activities across industries. One of the worst fallout of the outbreak of Covid-19 was the massive decline in domestic consumption, which also severely impacted the demand for folding cartons. Players in the ASEAN folding cartons market in collaboration with policy makers have been adopting strategies and business models to overcome the disruption in supply chain and put the economies of the path of growth in post-Covid-era. This will open interesting avenues for packaging manufacturers all over the world.