Global Application Development and Deployment Software Market: Snapshot

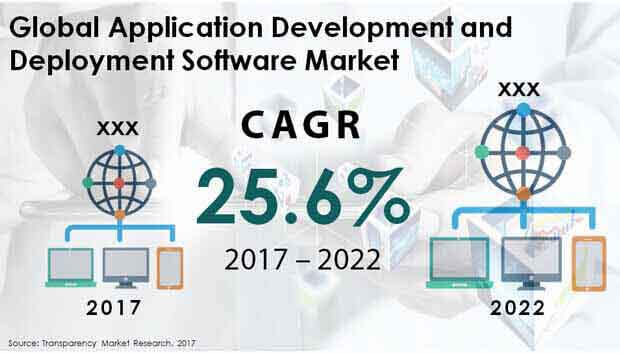

The demand in the global application development and deployment software market is projected to expand at an exceptional CAGR of 25.6% during the forecast period of 2017 to 2024. This market is chiefly driven by the sheer efficiency and integration benefits it offers, gaining traction in various application sectors such as BFSI, IT and telecommunications, and retail. As far as revenue is concerned, the global application development and deployment software market is anticipated to be worth US$346,434.0 mn by 2024, significantly up from its evaluated worth of US$110,650.7 mn in 2017.

Planning to lay down future strategy? Perfect your plan with our report sample here https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=30959

Structured Data Management Software Emerges as Profitable Type Segment

Based on type, the global application development and deployment software market is segmented into structured data management software, application development software, application server middleware, data access, analysis, and delivery, integration and process automation middleware, and quality and life cycle tools. Among these, the segment of structured data management software accounted for 37.7% of the total demand, which was worth US$41,760.1 mn. During the forecast period of 2017 to 2024, this segment is anticipated to experience an above-average CAGR of 31.5%, reaching a valuation of US$164,196.1 mn by 2024. The structured data management software segment of the application development and deployment software market is producing a revenue of US$24,487 annually during the said forecast period.

Cloud-based Deployment Gaining Rapid Popularity

On the basis of vertical, the global application development and deployment software market has been bifurcated into IT and telecommunications, banking, financial services, and insurance (BFSI), energy and utilities, transportation and logistics, retail and consumer goods, manufacturing, and others. Based on deployment, the market has been categorized into cloud-based and on-premise. While on-premise currently accounts for the most prominent chunk of demand, cloud-based application development and deployment software are gaining popularity at a rapid rate and is expected to turn into a highly profitable category towards the end of the forecast period.

North America and Europe Identified as Most Lucrative Regions

Geographically, besides the country-wide market of Japan, the report takes stock of the potential of application development and deployment software market in the regions of North America, Europe, Latin America, Asia Pacific except Japan (APEJ), and the Middle East and Africa (MEA). In 2017, the North America application development and deployment market accounted for US$31,691.3 mn, which was substantially more than any other region. This region is projected to possess a revenue of US$96,213.1 mn by the end of 2024, exhibiting a CAGR of 28.9% during the forecast period of 2017 to 2024. Europe makes for the second most lucrative region for the vendors operating in the application development and deployment software market, promising a worth of US$73,973.4 mn by 2024, expanding at an above-average CAGR of 25.9% during the same forecast period. On the other hand, the region of Asia Pacific except Japan has been predicted to expand the demand at most prominent compound annual growth rate of 29.3%, with the estimated worth projected to reach US$74,959.7 mn by 2024.

Looking for exclusive market insights from business experts? Buy Now Report here https://www.transparencymarketresearch.com/checkout.php?rep_id=30959<ype=S

Competition Intensifying as New Entrants are Making a Mark

The global application development and deployment software market is moderately consolidated with a few players holding strong positions. Some of those prominent companies are: Microsoft Corp., IBM, Salesforce.com, Inc., Oracle Corp., Hewlett Packard Enterprise Company, SAP SE, Alphabet Inc., CA Technology Inc., Compuware Corp., and ServiceNow, Inc. However, newer players are creating a niche for themselves by catering to domestic requirements and are expected to eat out good chunk of shares from the market leaders. Product innovation and acquisitions of promising players are the two most common strategies of the established players.