- Insurance analytics is a software platform that allows insurance companies to collect, analyze, and identify important insights from huge insurance databases to handle business risk and improve business in different insurance sectors.

- Insurance companies are adopting digital technologies and insurance analytics to improve the generation of leads, reduce fraudulent cases, improve customer satisfaction, prediction, and manage risk factors for improving business processes.

- Fraudulent cases regarding claim processing is one of the biggest challenges to the insurance industry. By using data analysis tools, an insurance company can identify the trend repeated for the claims process that helps to reduce fraudulent cases.

- Insurance companies are investing in analytics technologies to understand customer behavior, market patterns, and improve the business decision process. Insurance analytics allows companies to use advanced technologies such as Big Data and artificial intelligence (AI) which helps to enhance insurance-related services and competitive market strategies by analyzing huge data.

- Insurance analytics is majorly adopted by companies and brokers to efficiently track insurance payments, liquidity, and other financial operations, and monitor various operational expenses related to marketing, sales, customer support, and operations.

Key Drivers of the Insurance Analytics Market

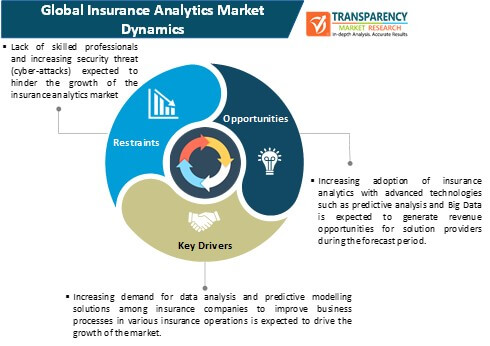

- Increasing demand for data analysis and predictive modelling solutions among insurance companies to improve business processes in various insurance operations is expected to drive the growth of the market. Increasing awareness about insurance analytics and digitalization among insurance companies and agencies to improve insurance services is also expected to boost the growth of the market.

- Increasing adoption of insurance analytics with advanced technologies such as predictive analysis and Big Data is expected to generate revenue opportunities for solution providers during the forecast period.

Lack of skilled professionals and increasing security threat (cyber-attacks) expected to hinder the growth of the insurance analytics market

- Increasing adoption of advanced data technologies in insurance sectors also creates multiple ways for cyber-attacks on a company’s confidential information related to banking, payment transactions, and policy details, which may restrain the growth of the market.

- Lack of skilled professionals among insurance companies and agencies to manage the different databases by using analytics solutions and business operations based on various technology platforms is also expected to hamper the growth of the market.

Impact of COVID-19 on the Global Insurance Analytics Market

- Insurance companies are expanding their geographical presence to capture more market share in Asia Pacific and Middle East & Africa due to the increasing impact of COVID-19 on business growth. Insurance companies and leading agencies are adopting new business strategies in claim processing and analyzing insurance records for services which creates revenue opportunities during lockdown conditions.

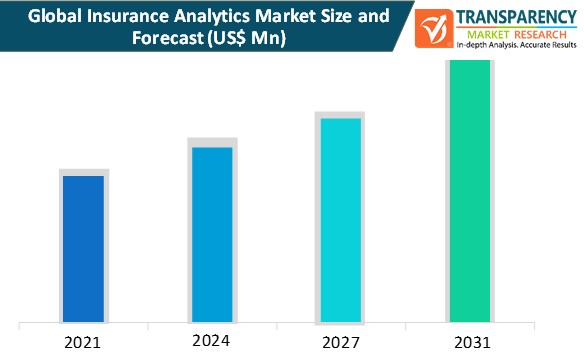

- Demand for insurance analytics is increasing during COVID-19 and is also set to increase during the forecast period due to increasing awareness about the benefits of insurance analytics among insurance companies with the increasing impact of COVID-19.

North America to Hold Major Share of the Global Insurance Analytics Market

- North America holds a prominent share of the insurance analytics market due to the early adoption of new technologies in the insurance sector by leading insurance companies and agencies to improve claim processing and transaction processing related to insurance in the region.

- The insurance analytics market in Asia Pacific is expected to expand the fastest during the forecast period due to the increasing adoption of technologically advanced software platforms to manage fraudulent claim cases, payment operational risk, and business risk in the region.

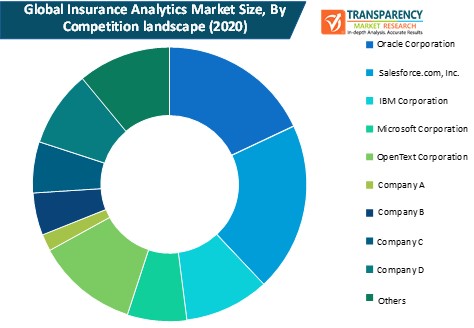

Key Players Operating in the Global Insurance Analytics Market

- Oracle Corporation

Oracle Corporation is a U.S.-based information technology company. The company provides applications, platforms, and IT infrastructure products and services. It has three business segments: Cloud and Licensing, Hardware, and Services. The company offers Oracle Insurance Analytics solutions for insurance and healthcare sectors.

- Salesforce.com, Inc.

Salesforce.com, Inc. is a global provider of customer relationship management services to different industries. The company provides a technological platform for businesses to build and run business applications. Salesforce.com, Inc. offers a solution that helps users to manage their customer records, sales, and other enterprise operational data.

Other key players operating in the global insurance analytics market include IBM Corporation, Microsoft Corporation, OpenText Corporation, Vertafore, Inc., MicroStrategy Incorporated, Hexaware Technologies Limited, and Pegasystems Inc.

Read Our Latest Press Release: